Page 157 - CRC_One Report 2021_EN

P. 157

Business Overview and Performance Corporate Governance Financial Statements Enclosure

1.4 Capital Registration and Paid-Up Capital

As at 31 December 2021, the Company register capital at THB 6,320,000,000 and paid-up capital at

THB 6,031,000,000 with par value at THB 1.0

1.5 Other securities

- None –

1.6 Dividend Payment Policy

1.6.1 Dividend Payment Policy of the Company

The Company will consider paying dividend according to provision of law, including the Public Limited Company

Act, B.E. 2535 (1992) (As amended), which stipulates that a public limited company may pay dividends only based

on its net profit as derived from its separate financial statements and may not pay dividends if it has negative

retained earnings.

The Company has a policy to pay dividends to shareholders at the rate of not less than 40% of the net profit from

the consolidated financial statements after tax deduction, the allocation of all various funds required by laws

and the Company in each year, and the obligations under the financial contract (if any). The dividend payment

must not exceed the retained earnings from the separate financial statements of the Company. The said dividend

payment rate may be changed from the specified depending on the results of operations, cash flow, financial

liquidity, financial status, investment plan, reserving funds to be working capital within the company, reserving

funds for future investment, reserving funds to repay loans, conditions and limitations as specified in the financial

contract, economic conditions, including legal requirements and other necessities.

In this regard, annual dividend payments must be approved by the shareholders’ meeting. The Board of Directors

may also, by resolution, approve to pay interim dividends to the shareholders if they deem that the Company

has sufficient profits to do so. Such dividends distribution must be reported shareholders at the next shareholders’

meeting accordingly. The shareholders / Board of Directors of the Company have approved dividends as follows:

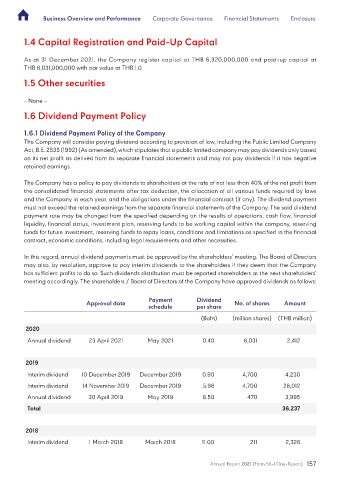

Payment Dividend

Approval date No. of shares Amount

schedule per share

(Baht) (million shares) (THB million)

2020

Annual dividend 23 April 2021 May 2021 0.40 6,031 2,412

2019

Interim dividend 10 December 2019 December 2019 0.90 4,700 4,230

Interim dividend 14 November 2019 December 2019 5.96 4,700 28,012

Annual dividend 30 April 2019 May 2019 8.50 470 3,995

Total 36,237

2018

Interim dividend 1 March 2018 March 2018 11.00 211 2,326

Annual Report 2021 (Form 56-1 One-Report) 157