Page 404 - CRC_One Report 2021_EN

P. 404

Business Overview and Performance Corporate Governance Financial Statements Enclosure

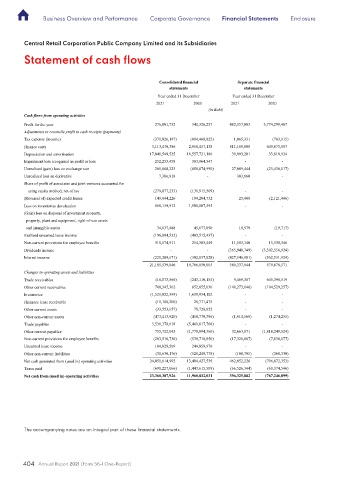

Central Retail Corporation Public Company Limited and its Subsidiaries

Statement of cash flows

Central Retail Corporation Public Company Limited and its Subsidiaries

Statement of cash flows

Consolidated financial Separate financial

statements statements

Year ended 31 December Year ended 31 December

2021 2020 2021 2020

(in Baht)

Cash flows from operating activities

Profit for the year 276,801,732 341,326,257 482,357,803 3,774,299,407

Adjustments to reconcile profit to cash receipts (payments)

Tax expense (income) (371,826,197) (884,468,825) 1,065,331 (783,115)

Finance costs 3,113,470,386 2,950,457,138 811,189,808 649,873,087

Depreciation and amortisation 17,040,549,525 16,557,721,186 39,993,201 33,810,924

Impairment loss recognised in profit or loss 252,253,458 383,964,547 - -

Unrealised (gain) loss on exchange rate 200,868,223 (658,874,990) 27,089,444 (23,430,017)

Unrealised loss on derivative 7,386,818 - 303,660 -

Share of profit of associates and joint ventures accounted for

using equity method, net of tax (279,077,233) (131,915,509) - -

(Reversal of) expected credit losses 149,944,226 194,204,732 23,408 (2,121,496)

Loss on inventories devaluation 868,139,912 1,500,007,395 - -

(Gain) loss on disposal of investment property,

property, plant and equipment, right-of-use assets

and intangible assets 34,637,488 45,677,090 18,979 (19,717)

Realised unearned lease income (196,894,532) (483,515,437) - -

Non-current provisions for employee benefits 310,574,911 254,303,449 11,583,140 13,338,346

Dividends income - - (365,940,749) (3,302,556,924)

Interest income (221,289,671) (302,037,028) (427,346,981) (562,531,924)

21,185,539,046 19,766,850,005 580,337,044 579,878,571

Changes in operating assets and liabilities

Trade receivables (18,073,566) (243,110,155) 9,469,387 645,398,519

Other current receivables 768,345,362 652,855,036 (140,273,046) (104,529,257)

Inventories (1,521,822,399) 1,639,934,102 - -

Finanace lease receivable (11,188,200) 20,771,475 - -

Other current assets (33,553,657) 78,728,052 - -

Other non-current assets (473,413,920) (458,779,396) (1,914,568) (1,274,255)

Trade payables 3,530,378,618 (5,461,817,768) - -

Other current payables 755,722,045 (1,778,894,360) 32,663,071 (1,818,249,524)

Non-current provisions for employee benefits (203,516,730) (536,718,650) (17,320,867) (7,836,077)

Unearned lease income 104,828,569 244,858,976 - -

Other non-current liabilities (31,630,176) (520,249,778) (108,795) (260,330)

Net cash generated from (used in) operating activities 24,051,614,992 13,404,427,539 462,852,226 (706,872,353)

Taxes paid (691,227,066) (1,443,615,508) (66,526,344) (60,374,546)

Net cash from (used in) operating activities 23,360,387,926 11,960,812,031 396,325,882 (767,246,899)

The accompanying notes are an integral part of these financial statements.

404 Annual Report 2021 (Form 56-1 One-Report)

The accompanying notes are an integral part of these financial statements.

14