Page 426 - CRC_One Report 2021_EN

P. 426

Business Overview and Performance Corporate Governance Financial Statements Enclosure

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

For the year ended 31 December 2021

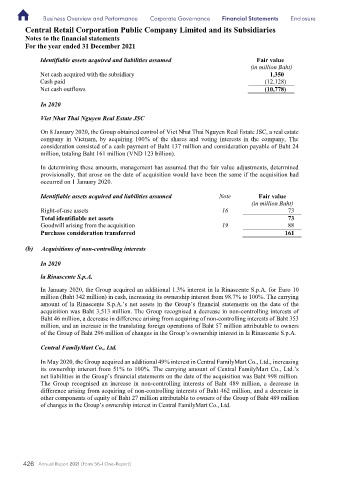

Identifiable assets acquired and liabilities assumed Fair value

(in million Baht)

Net cash acquired with the subsidiary 1,350

Cash paid (12,128)

Net cash outflows (10,778)

In 2020

Viet Nhat Thai Nguyen Real Estate JSC

On 8 January 2020, the Group obtained control of Viet Nhat Thai Nguyen Real Estate JSC, a real estate

company in Vietnam, by acquiring 100% of the shares and voting interests in the company, The

consideration consisted of a cash payment of Baht 137 million and consideration payable of Baht 24

million, totaling Baht 161 million (VND 123 billion).

In determining these amounts, management has assumed that the fair value adjustments, determined

provisionally, that arose on the date of acquisition would have been the same if the acquisition had

occurred on 1 January 2020.

Identifiable assets acquired and liabilities assumed Note Fair value

(in million Baht)

Right-of-use assets 16 73

Total identifiable net assets 73

Goodwill arising from the acquisition 19 88

Purchase consideration transferred 161

(b) Acquisitions of non-controlling interests

In 2020

la Rinascente S.p.A.

In January 2020, the Group acquired an additional 1.3% interest in la Rinascente S.p.A. for Euro 10

million (Baht 342 million) in cash, increasing its ownership interest from 98.7% to 100%. The carrying

amount of la Rinascente S.p.A.’s net assets in the Group’s financial statements on the date of the

acquisition was Baht 3,513 million. The Group recognised a decrease in non-controlling interests of

Baht 46 million, a decrease in difference arising from acquiring of non-controlling interests of Baht 353

million, and an increase in the translating foreign operations of Baht 57 million attributable to owners

of the Group of Baht 296 million of changes in the Group’s ownership interest in la Rinascente S.p.A.

Central FamilyMart Co., Ltd.

In May 2020, the Group acquired an additional 49% interest in Central FamilyMart Co., Ltd., increasing

its ownership interest from 51% to 100%. The carrying amount of Central FamilyMart Co., Ltd.’s

net liabilities in the Group’s financial statements on the date of the acquisition was Baht 998 million.

The Group recognised an increase in non-controlling interests of Baht 489 million, a decrease in

difference arising from acquiring of non-controlling interests of Baht 462 million, and a decrease in

other components of equity of Baht 27 million attributable to owners of the Group of Baht 489 million

of changes in the Group’s ownership interest in Central FamilyMart Co., Ltd.

36

426 Annual Report 2021 (Form 56-1 One-Report)