Page 453 - CRC_One Report 2021_EN

P. 453

Business Overview and Performance Corporate Governance Financial Statements Enclosure

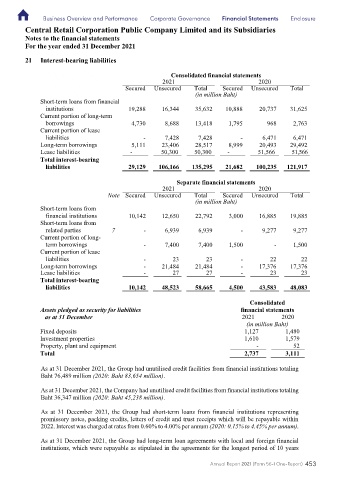

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

For the year ended 31 December 2021

21 Interest-bearing liabilities

Consolidated financial statements

2021 2020

Secured Unsecured Tota l Secured Unsecu red Total

(in million Baht)

Short-term loans from financial

institutions 19,288 16,344 35,632 10,888 20,737 31,625

Current portion of long-term

borrowings 4,730 8,688 13,418 1,795 968 2,763

Current portion of lease

liabilities - 7,428 7,428 - 6,471 6,471

Long-term borrowings 5,111 23,406 28,517 8,999 20,493 29,492

Lease liabilities - 50,300 50,300 - 51,566 51,566

Total interest-bearing

liabilities 29,129 106,166 135,295 21,682 100,235 121,917

Separate financial statements

2021 2020

Note Secured Unsecured Tota l Secured Unsecu red Total

(in million Baht)

Short-term loans from

financial institutions 10,142 12,650 22,792 3,000 16,885 19,885

Short-term loans from

related parties 7 - 6,939 6,939 - 9,277 9,277

Current portion of long-

term borrowings - 7,400 7,400 1,500 - 1,500

Current portion of lease

liabilities - 23 23 - 22 22

Long-term borrowings - 21,484 21,484 - 17,376 17,376

Lease liabilities - 27 27 - 23 23

Total interest-bearing

liabilities 10,142 48,523 58,665 4,500 43,583 48,083

Consolidated

Assets pledged as security for liabilities financial statements

as at 31 December 2021 2020

(in million Baht)

Fixed deposits 1,127 1,480

Investment properties 1,610 1,579

Property, plant and equipment - 52

Total 2,737 3,111

As at 31 December 2021, the Group had unutilised credit facilities from financial institutions totaling

Baht 76,489 million (2020: Baht 83,654 million).

As at 31 December 2021, the Company had unutilised credit facilities from financial institutions totaling

Baht 36,347 million (2020: Baht 45,238 million).

As at 31 December 2021, the Group had short-term loans from financial institutions representing

promissory notes, packing credits, letters of credit and trust receipts which will be repayable within

2022. Interest was charged at rates from 0.60% to 4.00% per annum (2020: 0.15% to 4.45% per annum).

As at 31 December 2021, the Group had long-term loan agreements with local and foreign financial

institutions, which were repayable as stipulated in the agreements for the longest period of 10 years

63

Annual Report 2021 (Form 56-1 One-Report) 453