Page 17 - 2022_OE Benefits Guide

P. 17

How We Determine What You Pay for BCBS Medical/Prescription Plan Rates

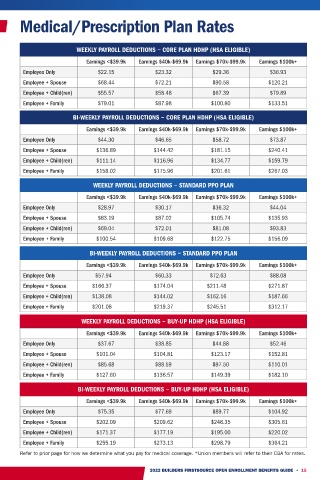

Medical/Prescription Coverage WEEKLY PAYROLL DEDUCTIONS − CORE PLAN HDHP (HSA ELIGIBLE)

Team member premium deductions for medical/prescription coverage are based on your annual Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

Base Pay Rate. The Base Pay Rate is established for each team member prior to Open Enrollment Employee Only $22.15 $23.32 $29.36 $36.93

and a new hire’s initial coverage effective date. The Base Pay Rate is determined as follows:

Employee + Spouse $68.44 $72.21 $90.58 $120.21

Hourly Non-Variable Team Members – Annualized base hourly rate of pay, not counting overtime. Employee + Child(ren) $55.57 $58.48 $67.39 $79.89

Employee + Family $79.01 $87.98 $100.80 $133.51

Salaried Non-Variable Team Members – Base annual rate of pay, not counting bonuses.

BI-WEEKLY PAYROLL DEDUCTIONS − CORE PLAN HDHP (HSA ELIGIBLE)

Variable Pay & Commission-based Team Members – Actual earnings from piecework, weight or zone Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

pay, and/or commission earnings received.

Employee Only $44.30 $46.65 $58.72 $73.87

For purposes of this open enrollment, the earnings period used to determine your Base Pay Rate is Employee + Spouse $136.89 $144.42 $181.15 $240.41

as follows: Employee + Child(ren) $111.14 $116.96 $134.77 $159.79

Employee + Family $158.02 $175.96 $201.61 $267.03

Your earnings received from September 1, 2020 through August 31, 2021.

WEEKLY PAYROLL DEDUCTIONS − STANDARD PPO PLAN

For newly eligible and team members with less than 12 months of Earnings, the Base Pay Rate will

be projected. Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

Employee Only $28.97 $30.17 $36.32 $44.04

Base Plus Team Members – The annualized base hourly rate of pay (if hourly) or base annual rate

of pay (if salaried) plus earnings attributable to piecework, weight or zone pay, and/or commission Employee + Spouse $83.19 $87.02 $105.74 $135.93

earnings received during the earnings period referenced under the bulleted item ‘Variable Pay Employee + Child(ren) $69.04 $72.01 $81.08 $93.83

& Commission-based Team Members’. For newly eligible and team members with less than 12 Employee + Family $100.54 $109.68 $122.75 $156.09

months of earnings, the Base Pay Rate will be projected.

BI-WEEKLY PAYROLL DEDUCTIONS − STANDARD PPO PLAN

When you log into Dayforce to enroll or to review your current benefits, you will see your costs for all Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

coverages as you move through the application.

Employee Only $57.94 $60.33 $72.63 $88.08

For benefits purposes, your Base Pay Rate is established once for the plan year and will NOT Employee + Spouse $166.37 $174.04 $211.48 $271.87

change until the next plan year. Employee + Child(ren) $138.08 $144.02 $162.16 $187.66

Did You Know? Employee + Family $201.08 $219.37 $245.51 $312.17

The medical/RX plans offered through Builders FirstSource are self-funded. This means we pay WEEKLY PAYROLL DEDUCTIONS − BUY-UP HDHP (HSA ELIGIBLE)

BlueCross BlueShield and CVS/Caremark to administer the plans, pay claims and provide access

to contracted providers, with whom discounts for services and prescription drugs have been Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

negotiated. We pay many millions of dollars for these costs each year. As team members, you share Employee Only $37.67 $38.85 $44.88 $52.46

in the cost of the plan too. As consumers of healthcare services in the plan, you can help hold down Employee + Spouse $101.04 $104.81 $123.17 $152.81

future cost increases by doing things like making sure your medications are generic when possible, Employee + Child(ren) $85.68 $88.59 $97.50 $110.01

taking preventive steps to avoid larger problems, and make sure to use the most cost effective care

options. Employee + Family $127.60 $136.57 $149.39 $182.10

BI-WEEKLY PAYROLL DEDUCTIONS − BUY-UP HDHP (HSA ELIGIBLE)

Earnings <$39.9k Earnings $40k-$69.9k Earnings $70k-$99.9k Earnings $100k+

Employee Only $75.35 $77.69 $89.77 $104.92

Employee + Spouse $202.09 $209.62 $246.35 $305.61

Employee + Child(ren) $171.37 $177.19 $195.00 $220.02

Employee + Family $255.19 $273.13 $298.79 $364.21

Refer to prior page for how we determine what you pay for medical coverage. *Union members will refer to their CBA for rates.

14 • 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE • 15