Page 20 - 2020 Benefits Guide

P. 20

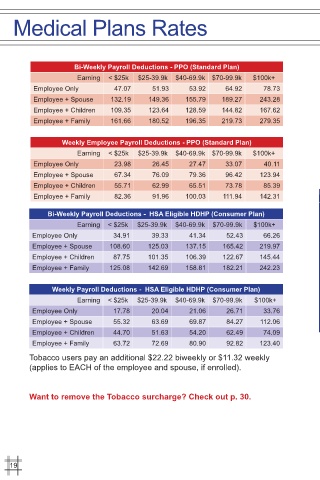

Medical Plans Rates

Bi-Weekly Payroll Deductions - PPO (Standard Plan)

Earning < $25k $25-39.9k $40-69.9k $70-99.9k $100k+

Employee Only 47.07 51.93 53.92 64.92 78.73

Employee + Spouse 132.19 149.36 155.79 189.27 243.28

Employee + Children 109.35 123.64 128.59 144.82 167.62

Employee + Family 161.66 180.52 196.35 219.73 279.35

Weekly Employee Payroll Deductions - PPO (Standard Plan)

Earning < $25k $25-39.9k $40-69.9k $70-99.9k $100k+

Employee Only 23.98 26.45 27.47 33.07 40.11

Employee + Spouse 67.34 76.09 79.36 96.42 123.94

Employee + Children 55.71 62.99 65.51 73.78 85.39

Employee + Family 82.36 91.96 100.03 111.94 142.31

Bi-Weekly Payroll Deductions - HSA Eligible HDHP (Consumer Plan)

Earning < $25k $25-39.9k $40-69.9k $70-99.9k $100k+

Employee Only 34.91 39.33 41.34 52.43 66.26

Employee + Spouse 108.60 125.03 137.15 165.42 219.97

Employee + Children 87.75 101.35 106.39 122.67 145.44

Employee + Family 125.08 142.69 158.81 182.21 242.23

Weekly Payroll Deductions - HSA Eligible HDHP (Consumer Plan)

Earning < $25k $25-39.9k $40-69.9k $70-99.9k $100k+

Employee Only 17.78 20.04 21.06 26.71 33.76

Employee + Spouse 55.32 63.69 69.87 84.27 112.06

Employee + Children 44.70 51.63 54.20 62.49 74.09

Employee + Family 63.72 72.69 80.90 92.82 123.40

Tobacco users pay an additional $22.22 biweekly or $11.32 weekly

(applies to EACH of the employee and spouse, if enrolled).

Want to remove the Tobacco surcharge? Check out p. 30.

19