Page 18 - mutual-fund-insight - Mar 2021_Neat

P. 18

FUND RADAR

How to reduce your NPS

transaction costs

NPS transaction costs can consume a chunk of your savings over time. Here’s

how you can bring them down.

he National Pension System (NPS) has seen the phase, at the age of 60, you can make a tax-free

number of subscribers under the ‘All Citizen’ withdrawal of the 60 per cent of the corpus. The

Tmodel (meant for citizens other than central/ remaining 40 per cent has to be utilised for buying an

state-government employees) rise to 14.44 lakh as annuity plan, which gets you regular income

on December 31, 2020, as against 78,774 in during your golden years.

March 2014. By the end of 2020, the total You can open an NPS account either

number of subscribers across various through a point of presence (POP) or

models of the NPS reached close to 1.40 directly through the Central Record

crore, with the AUM being more than Keeping Agency (CRA). Let us first

`5.34 lakh crore. understand what a POP and the CRA

This government-backed long-term are. A POP is appointed to open and

investment plan intends to secure the provide all the related services under the

post-retirement years of its subscribers by NPS through its network of branches. Just

helping them accumulate a corpus. Also, it visit a POP and they will help you open the

helps subscribers get an additional deduction of account. The list of POPs can be found at https://

up to `50,000 over and above the Section 80C limit of bit.ly/3ctjbPD. Almost all banks and even post offices

`1.5 lakh. While you can enjoy tax benefit on the are POPs.

investments made in the NPS during the accumulation On the other hand, CRA is an agency which

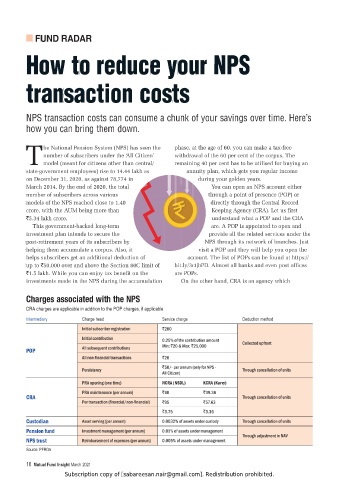

*OHYNLZ HZZVJPH[LK ^P[O [OL 57:

CRA charges are applicable in addition to the POP charges, if applicable

Intermediary Charge head Service charge Deduction method

Initial subscriber registration `200

Initial contribution 0.25% of the contribution amount Collected upfront

POP All subsequent contributions Min: `20 & Max: `25,000

$OO QRQ ÀQDQFLDO WUDQVDFWLRQV `20

` SHU DQQXP RQO\ IRU 136

Persistency Through cancellation of units

All Citizen)

PRA opening (one time) NCRA (NSDL) KCRA (Karvy)

PRA maintenance (per annum) `40 `39.36

CRA Through cancellation of units

3HU WUDQVDFWLRQ ÀQDQFLDO QRQ ÀQDQFLDO `95 `57.63

`3.75 `3.36

Custodian Asset serving (per annum) 0.0032% of assets under custody Through cancellation of units

Pension fund Investment management (per annum) 0.01% of assets under management

Through adjustment in NAV

NPS trust Reimbursement of expenses (per annum) 0.005% of assets under management

Source: PFRDA

16 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.