Page 1064 - How to Make Money in Stocks Trilogy

P. 1064

50 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

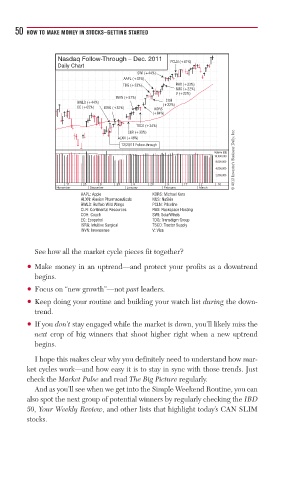

Nasdaq Follow-Through – Dec. 2011 PCLN (+41%)

Daily Chart 3000

SWI (+44%)

AAPL (+33%)

TDG (+33%) RAX (+33%)

NUS (+22%)

V (+22%) 2800

INVN (+87%)

COH

BWLD (+44%) (+22%)

EC (+65%) ISRG (+32%) KORS

(+84%)

TSCO (+34%)

© 2013 Investor’s Business Daily, Inc.

CLR (+33%)

ALXN (+48%)

12/20/11 Follow-through

Volume (00)

14,000,000

8,000,000

4,000,000

2,000,000

11 25 9 23 6 20 3 17 2 16

November December January February March

AAPL: Apple KORS: Michael Kors

ALXN: Alexion Pharmaceuticals NUS: NuSkin

BWLD: Buffalo Wild Wings PCLN: Priceline

CLR: Continental Resources RAX: Rackspace Hosting

COH: Coach SWI: SolarWinds

EC: Ecopetrol TDG: Transdigm Group

ISRG: Intuitive Surgical TSCO: Tractor Supply

INVN: Invensense V: Visa

See how all the market cycle pieces fit together?

• Make money in an uptrend—and protect your profits as a downtrend

begins.

• Focus on “new growth”—not past leaders.

• Keep doing your routine and building your watch list during the down-

trend.

• If you don’t stay engaged while the market is down, you’ll likely miss the

next crop of big winners that shoot higher right when a new uptrend

begins.

I hope this makes clear why you definitely need to understand how mar-

ket cycles work—and how easy it is to stay in sync with those trends. Just

check the Market Pulse and read The Big Picture regularly.

And as you’ll see when we get into the Simple Weekend Routine, you can

also spot the next group of potential winners by regularly checking the IBD

50, Your Weekly Review, and other lists that highlight today’s CAN SLIM

stocks.