Page 321 - How to Make Money in Stocks Trilogy

P. 321

198 A WINNING SYSTEM

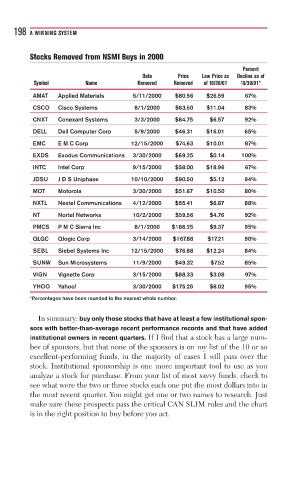

Stocks Removed from NSMI Buys in 2000

Percent

Date Price Low Price as Decline as of

Symbol Name Removed Removed of 10/30/01 10/30/01*

AMAT Applied Materials 5/11/2000 $80.56 $26.59 67%

CSCO Cisco Systems 8/1/2000 $63.50 $11.04 83%

CNXT Conexant Systems 3/3/2000 $84.75 $6.57 92%

DELL Dell Computer Corp 5/9/2000 $46.31 $16.01 65%

EMC E M C Corp 12/15/2000 $74.63 $10.01 87%

EXDS Exodus Communications 3/30/2000 $69.25 $0.14 100%

INTC Intel Corp 9/15/2000 $58.00 $18.96 67%

JDSU J D S Uniphase 10/10/2000 $90.50 $5.12 94%

MOT Motorola 3/30/2000 $51.67 $10.50 80%

NXTL Nextel Communications 4/12/2000 $55.41 $6.87 88%

NT Nortel Networks 10/2/2000 $59.56 $4.76 92%

PMCS P M C Sierra Inc 8/1/2000 $186.25 $9.37 95%

QLGC Qlogic Corp 3/14/2000 $167.88 $17.21 90%

SEBL Siebel Systems Inc 12/15/2000 $76.88 $12.24 84%

SUNW Sun Microsystems 11/9/2000 $49.32 $7.52 85%

VIGN Vignette Corp 3/15/2000 $88.33 $3.08 97%

YHOO Yahoo! 3/30/2000 $175.25 $8.02 95%

*Percentages have been rounded to the nearest whole number.

In summary: buy only those stocks that have at least a few institutional spon-

sors with better-than-average recent performance records and that have added

institutional owners in recent quarters. If I find that a stock has a large num-

ber of sponsors, but that none of the sponsors is on my list of the 10 or so

excellent-performing funds, in the majority of cases I will pass over the

stock. Institutional sponsorship is one more important tool to use as you

analyze a stock for purchase. From your list of most savvy funds, check to

see what were the two or three stocks each one put the most dollars into in

the most recent quarter. You might get one or two names to research. Just

make sure these prospects pass the critical CAN SLIM rules and the chart

is in the right position to buy before you act.