Page 361 - How to Make Money in Stocks Trilogy

P. 361

236 A WINNING SYSTEM

Conventional wisdom or consensus thinking in the market is seldom

right. I never pay any attention to the parade of experts voicing their per-

sonal opinions on the market in print or on TV. It creates entirely too much

confusion and can cost you a great deal of money. In 2000, some strategists

were telling people to buy the dips (short-term declines in price) because

the cash position of mutual funds had increased greatly and all this money

was sitting on the sidelines waiting to be invested. To prove this wrong, all

anyone had to do was look at the General Markets & Sectors page in

Investor’s Business Daily. It showed that while mutual fund cash positions

had indeed risen, they were still significantly below their historical highs

and even below their historical averages.

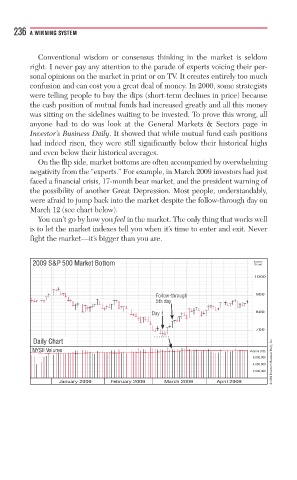

On the flip side, market bottoms are often accompanied by overwhelming

negativity from the “experts.” For example, in March 2009 investors had just

faced a financial crisis, 17-month bear market, and the president warning of

the possibility of another Great Depression. Most people, understandably,

were afraid to jump back into the market despite the follow-through day on

March 12 (see chart below).

You can’t go by how you feel in the market. The only thing that works well

is to let the market indexes tell you when it’s time to enter and exit. Never

fight the market—it’s bigger than you are.

2009 S&P 500 Market Bottom Index

Scale

1000

F Folloollol ww-throughthroughh h h h 900

5th dayday y

5th

y 1111

D Day 1 800

Day

700

Daily Chart

© 2009 Investor’s Business Daily, Inc.

NYSE Volume Volume (00)

8,000,000

4,000,000

2,000,000

January 2009 February 2009 March 2009 April 2009