Page 519 - How to Make Money in Stocks Trilogy

P. 519

388 INVESTING LIKE A PROFESSIONAL

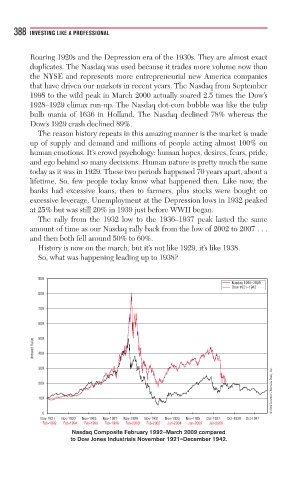

Roaring 1920s and the Depression era of the 1930s. They are almost exact

duplicates. The Nasdaq was used because it trades more volume now than

the NYSE and represents more entrepreneurial new America companies

that have driven our markets in recent years. The Nasdaq from September

1998 to the wild peak in March 2000 actually soared 2.5 times the Dow’s

1928–1929 climax run-up. The Nasdaq dot-com bubble was like the tulip

bulb mania of 1636 in Holland. The Nasdaq declined 78% whereas the

Dow’s 1929 crash declined 89%.

The reason history repeats in this amazing manner is the market is made

up of supply and demand and millions of people acting almost 100% on

human emotions. It’s crowd psychology: human hopes, desires, fears, pride,

and ego behind so many decisions. Human nature is pretty much the same

today as it was in 1929. These two periods happened 70 years apart, about a

lifetime. So, few people today know what happened then. Like now, the

banks had excessive loans, then to farmers, plus stocks were bought on

excessive leverage. Unemployment at the Depression lows in 1932 peaked

at 25% but was still 20% in 1939 just before WWII began.

The rally from the 1932 low to the 1936–1937 peak lasted the same

amount of time as our Nasdaq rally back from the low of 2002 to 2007 . . .

and then both fell around 50% to 60%.

History is now on the march, but it’s not like 1929, it’s like 1938.

So, what was happening leading up to 1938?

900

Nasdaq 1992–2009

Dow 1921–1942

800

700

600

Indexed Value 500

400

300

© 2009 Investor’s Business Daily, Inc.

200

100

0

Nov-1921 Nov-1923 Nov-1925 Nov-1927 Nov-1929 Nov-1931 Nov-1933 Nov-1935 Oct-1937 Oct-1939 Oct-1941

Feb-1992 Feb-1994 Feb-1996 Feb-1998 Feb-2000 Feb-2002 Jan-2004 Jan-2006 Jan-2008

Nasdaq Composite February 1992–March 2009 compared

to Dow Jones Industrials November 1921–December 1942.