Page 119 - Account 10

P. 119

Jestha 5 Withdrawn Rs. 2,000 on a permanent basis out of capital.

Jestha 6 Brought in additional capital of Rs. 5,000.

Jestha 9 Sale of goods Rs. 9,500.

Jestha 10 Drawings made during the year Rs. 2,500.

Jestha 12 Furniture purchased from Pooja Rs.10,000.

Jestha 15 Goods purchased from Manish Rs. 5,000.

Jestha 22 Goods purchased Rs. 3,000.

Jestha 30 Paid salaries Rs. 3,000.

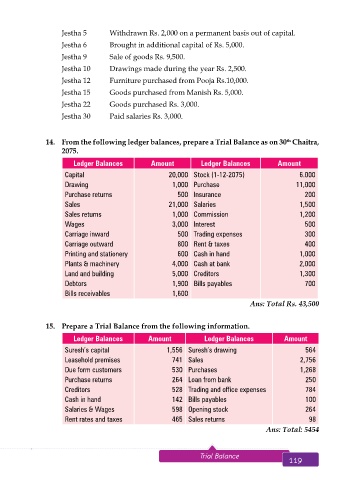

14. From the following ledger balances, prepare a Trial Balance as on 30 Chaitra,

th

2075.

Ledger Balances Amount Ledger Balances Amount

Capital 20,000 Stock (1-12-2075) 6.000

Drawing 1,000 Purchase 11,000

Purchase returns 500 Insurance 200

Sales 21,000 Salaries 1,500

Sales returns 1,000 Commission 1,200

Wages 3,000 Interest 500

Carriage inward 500 Trading expenses 300

Carriage outward 800 Rent & taxes 400

Printing and stationery 600 Cash in hand 1,000

Plants & machinery 4,000 Cash at bank 2,000

Land and building 5,000 Creditors 1,300

Debtors 1,900 Bills payables 700

Bills receivables 1,600

Ans: Total Rs. 43,500

15. Prepare a Trial Balance from the following information.

Ledger Balances Amount Ledger Balances Amount

Suresh’s capital 1,556 Suresh’s drawing 564

Leasehold premises 741 Sales 2,756

Due form customers 530 Purchases 1,268

Purchase returns 264 Loan from bank 250

Creditors 528 Trading and office expenses 784

Cash in hand 142 Bills payables 100

Salaries & Wages 598 Opening stock 264

Rent rates and taxes 465 Sales returns 98

Ans: Total: 5454

118 Aakar’s Office Practice and Accountancy - 10 Trial Balance 119