Page 126 - Account 10

P. 126

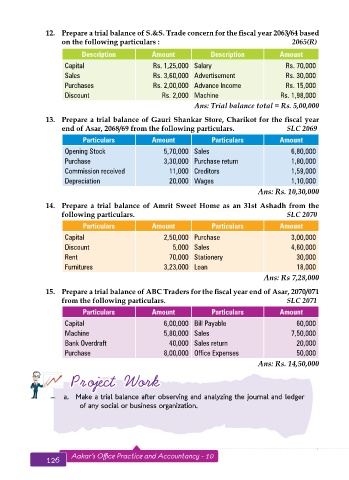

12. Prepare a trial balance of S.&S. Trade concern for the fiscal year 2063/64 based

on the following particulars : 2065(R)

Description Amount Description Amount

Capital Rs. 1,25,000 Salary Rs. 70,000

Sales Rs. 3,60,000 Advertisement Rs. 30,000

Purchases Rs. 2,00,000 Advance Income Rs. 15,000

Discount Rs. 2,000 Machine Rs. 1,98,000

Ans: Trial balance total = Rs. 5,00,000

13. Prepare a trial balance of Gauri Shankar Store, Charikot for the fiscal year

end of Asar, 2068/69 from the following particulars. SLC 2069

Particulars Amount Particulars Amount

Opening Stock 5,70,000 Sales 6,80,000

Purchase 3,30,000 Purchase return 1,80,000

Commission received 11,000 Creditors 1,59,000

Depreciation 20,000 Wages 1,10,000

Ans: Rs. 10,30,000

14. Prepare a trial balance of Amrit Sweet Home as an 31st Ashadh from the

following particulars. SLC 2070

Particulars Amount Particulars Amount

Capital 2,50,000 Purchase 3,00,000

Discount 5,000 Sales 4,60,000

Rent 70,000 Stationery 30,000

Furnitures 3,23,000 Loan 18,000

Ans: Rs 7,28,000

15. Prepare a trial balance of ABC Traders for the fiscal year end of Asar, 2070/071

from the following particulars. SLC 2071

Particulars Amount Particulars Amount

Capital 6,00,000 Bill Payable 60,000

Machine 5,80,000 Sales 7,50,000

Bank Overdraft 40,000 Sales return 20,000

Purchase 8,00,000 Office Expenses 50,000

Ans: Rs. 14,50,000

Project Work

a. Make a trial balance after observing and analyzing the journal and ledger

of any social or business organization.

T

rial Balance

Aakar’s Office Practice and Accountancy - 10

127

126 Aakar’s Office Practice and Accountancy - 10 Final Accounts 127

126