Page 276 - Account 10

P. 276

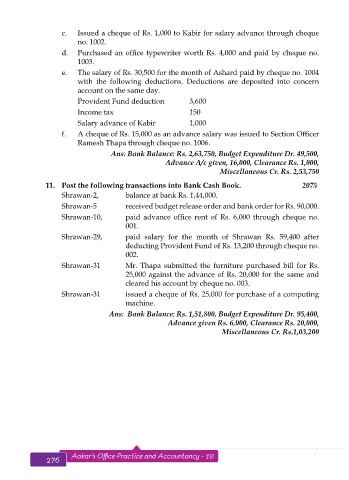

c. Issued a cheque of Rs. 1,000 to Kabir for salary advance through cheque

no. 1002.

d. Purchased an office typewriter worth Rs. 4,000 and paid by cheque no.

1003.

e. The salary of Rs. 30,500 for the month of Ashard paid by cheque no. 1004

with the following deductions. Deductions are deposited into concern

account on the same day.

Provident Fund deduction 3,600

Income tax 150

Salary advance of Kabir 1,000

f. A cheque of Rs. 15,000 as an advance salary was issued to Section Officer

Ramesh Thapa through cheque no. 1006.

Ans: Bank Balance: Rs. 2,63,750, Budget Expenditure Dr. 49,500,

Advance A/c given, 16,000, Clearance Rs. 1,000,

Miscellaneous Cr. Rs. 2,53,750

11. Post the following transactions into Bank Cash Book. 2075

Shrawan-2, balance at bank Rs. 1,44,000.

Shrawan-5 received budget release order and bank order for Rs. 90,000.

Shrawan-10, paid advance office rent of Rs. 6,000 through cheque no.

001.

Shrawan-29, paid salary for the month of Shrawan Rs. 59,400 after

deducting Provident Fund of Rs. 13,200 through cheque no.

002.

Shrawan-31 Mr. Thapa submitted the furniture purchased bill for Rs.

25,000 against the advance of Rs. 20,000 for the same and

cleared his account by cheque no. 003.

Shrawan-31 issued a cheque of Rs. 25,000 for purchase of a computing

machine.

Ans: Bank Balance: Rs. 1,51,800, Budget Expenditure Dr. 95,400,

Advance given Rs. 6,000, Clearance Rs. 20,000,

Miscellaneous Cr. Rs.1,03,200

Budget Sheet

Aakar’s Office Practice and Accountancy - 10

277

276

276 Aakar’s Office Practice and Accountancy - 10 Bank Cash Book 277