Page 57 - Account 10

P. 57

are payable by the customer. The insurance premium is free to the importer under this

condition.

C & F price = cost of goods + expenses incurred till the goods are loaded on board

of the ship + freight of the ship.

iv. Cost, Insurance and Freight Invoice (CIF Invoice)

It is a cost, insurance and freight invoice. It is prepared by adding the marine

insurance to the C & F price. CIF invoice is that invoice, which includes all the cost and

expenses incurred in the carriage of goods along with their value. No exemption is given

to the customer in regard to expenses.

CIF price. = cost of goods + expenses incurred till the goods are loaded on board

of the ship + freight of the ship + insurance charge of marine.

v. Franco Invoice

Franco means free, and hence it is free of cost invoice. No item of expenses except

the price of the goods is mentioned in this invoice. It means all the expenses like freight,

insurance, tax, etc. which the supplier in the carriage of the goods has incurred while

delivering the goods from the exporter godown to importer godown are included in the

invoice.

Franco invoice = cost of goods + expenses incurred till the goods are loaded on

board of the ship + freight of the ship + insurance charge of marine

+ other expenses incurred till the goods are placed in the godown

of the importer

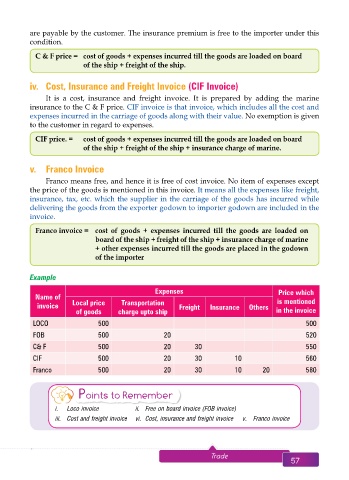

Example

Expenses Price which

Name of

invoice Local price Transportation Freight Insurance Others is mentioned

of goods charge upto ship in the invoice

LOCO 500 500

FOB 500 20 520

C& F 500 20 30 550

CIF 500 20 30 10 560

Franco 500 20 30 10 20 580

Points to Remember

i. Loco invoice ii. Free on board invoice (FOB invoice)

iii. Cost and freight invoice vi. Cost, insurance and freight invoice v. Franco invoice

56 Aakar’s Office Practice and Accountancy - 10 Trade 57