Page 71 - Account 10

P. 71

viii. Provides Locker Facilities

If we keep valuable good properties like gold, ornaments, diamonds, silver,

documents like share certificate, land certificate, etc. at home, it is risky. Commercial

bank provides locker facilities to its clients to preserve the valuable assets by paying

service charge to the bank.

ix. Purchases and Sells Securities

The commercial bank purchases and sells securities, shares and debentures on behalf

of its customers through stock exchange and capital markets. It helps to promote trade

and industries.

x. Creates Credit

Credit creation is a unique function of commercial bank. Commercial banks supply

money as loan to traders and industrialists. Bank deposits are regarded as money. When

bank grants loan to its customer, it does not pay cash. It simply credits the account of the

borrower. The borrower can withdraw the amount by cheques whenever required. In this

situation, the commercial bank creates deposit without receiving cash.

xi. Other Functions

Commercial banks manage to keep gold, silver and other valuable property safely,

avail money by purchasing/accepting bills (specially of 90 days terms) and provide

commercial services like financing for transportation carriage, storage, etc. These banks

also activate all the economic sectors by collecting savings and mobilising capital for

strengthening national economy.

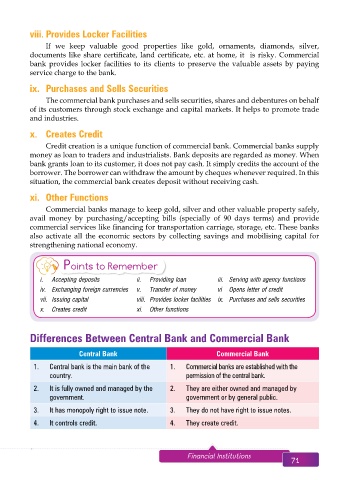

Points to Remember

i. Accepting deposits ii. Providing loan iii. Serving with agency functions

iv. Exchanging foreign currencies v. Transfer of money vi Opens letter of credit

vii. Issuing capital viii. Provides locker facilities ix. Purchases and sells securities

x. Creates credit xi. Other functions

Differences Between Central Bank and Commercial Bank

Central Bank Commercial Bank

1. Central bank is the main bank of the 1. Commercial banks are established with the

country. permission of the central bank.

2. It is fully owned and managed by the 2. They are either owned and managed by

government. government or by general public.

3. It has monopoly right to issue note. 3. They do not have right to issue notes.

4. It controls credit. 4. They create credit.

70 Aakar’s Office Practice and Accountancy - 10 Financial Institutions 71