Page 76 - Office Practice and Accounting 10

P. 76

iv. Errors of duplication: An error of duplication occurs when the same transaction

has been recorded twice in the books of original entry and also posted twice in

the ledger. E.g. purchase worth Rs. 7000 may be recorded twice in the accounts.

v. Errors of principle: Errors of principle occurs due to the violation of fundamental

principles of accounting. This may be due to lack of correct knowledge of

the accounting principle on the part of the recording clerks. E.g. salary paid

recorded in wages, purchase of assets recorded in purchase book etc.

Adjustment and closing of trial balance or suspense account

When the trial balance does not agree and error still are undetected due to the limited

time, suspense account is opened to make the trial balance equal and account is closed.

Thus, suspence account is a temporary account opened to make the trial balance

equal. It is opened to rectify only those errors which affect the trial balance. Debit

balance of suspense account is taken to assets side and credit balance of suspense

account is taken to liability side of balance sheet. The amount appearing on the debit

or credit side of suspense account is result of one sided error. After locating such

errors suspense account should be closed.

Illustrations

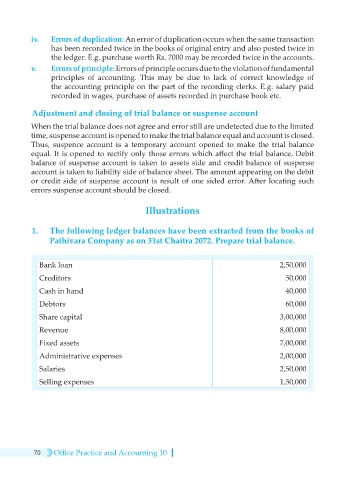

1. The following ledger balances have been extracted from the books of

Pathivara Company as on 31st Chaitra 2072. Prepare trial balance.

Bank loan 2,50,000

Creditors 50,000

Cash in hand 40,000

Debtors 60,000

Share capital 3,00,000

Revenue 8,00,000

Fixed assets 7,00,000

Administrative expenses 2,00,000

Salaries 2,50,000

Selling expenses 1,50,000

70 Office Practice and Accounting 10