Page 91 - Office Practice and Accounting 10

P. 91

5. All manufacturing expenses: All direct expenses that are incurred during the

production of goods such as octroi, import duty, excise duty, consumable goods,

motive power, coal, gas and water, factory expenses, dock charges, royalty, etc.

Items to be credited to trading account

1. Sales: Sales are the main source of revenue of business. Both cash and credit

sales should be recorded as revenue. It refers to the sales of those things/goods

which have been bought for resale purpose. It implies that sales of assets are not

treated to trading account. Sales returns or returns inwards, should be deducted

from the total sales as amount of net sale should be recorded.

2. Closings stock: Closing stock is the value of unsold goods at the end of current

period. In manufacturing company, three types of goods may remain as closing

stock :

i. closing stock of raw materials

ii. closing stock of work–in–progress and

iii. closing stock of finished goods.

Closing stock is treated to the credit side of the trading account.

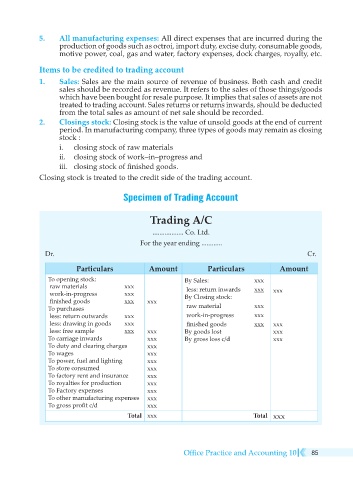

Specimen of Trading Account

Trading A/C

.................. Co. Ltd.

For the year ending ............

Dr. Cr.

Particulars Amount Particulars Amount

To opening stock: By Sales: xxx

raw materials xxx less: return inwards xxx

work-in-progress xxx By Closing stock: xxx

finished goods xxx xxx

To purchases raw material xxx

less: return outwards xxx work-in-progress xxx

less: drawing in goods xxx finished goods xxx xxx

less: free sample xxx xxx By goods lost xxx

To carriage inwards xxx By gross loss c/d xxx

To duty and clearing charges xxx

To wages xxx

To power, fuel and lighting xxx

To store consumed xxx

To factory rent and insurance xxx

To royalties for production xxx

To Factory expenses xxx

To other manufacturing expenses xxx

To gross profit c/d xxx

Total xxx Total xxx

Office Practice and Accounting 10 85