Page 114 - Office Practice and Accounting -9

P. 114

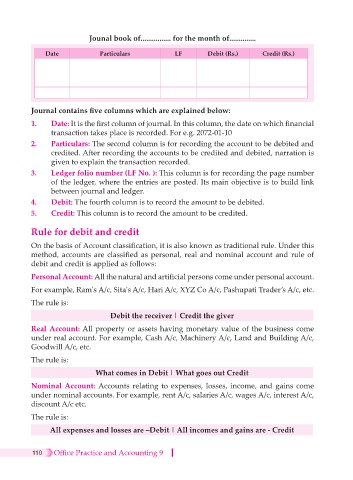

Jounal book of................ for the month of..............

Date Particulars LF Debit (Rs.) Credit (Rs.)

Journal contains five columns which are explained below:

1. Date: It is the first column of journal. In this column, the date on which financial

transaction takes place is recorded. For e.g. 2072-01-10

2. Particulars: The second column is for recording the account to be debited and

credited. After recording the accounts to be credited and debited, narration is

given to explain the transaction recorded.

3. Ledger folio number (LF No. ): This column is for recording the page number

of the ledger, where the entries are posted. Its main objective is to build link

between journal and ledger.

4. Debit: The fourth column is to record the amount to be debited.

5. Credit: This column is to record the amount to be credited.

Rule for debit and credit

On the basis of Account classification, it is also known as traditional rule. Under this

method, accounts are classified as personal, real and nominal account and rule of

debit and credit is applied as follows:

Personal Account: All the natural and artificial persons come under personal account.

For example, Ram's A/c, Sita's A/c, Hari A/c, XYZ Co A/c, Pashupati Trader’s A/c, etc.

The rule is:

Debit the receiver | Credit the giver

Real Account: All property or assets having monetary value of the business come

under real account. For example, Cash A/c, Machinery A/c, Land and Building A/c,

Goodwill A/c, etc.

The rule is:

What comes in Debit | What goes out Credit

Nominal Account: Accounts relating to expenses, losses, income, and gains come

under nominal accounts. For example, rent A/c, salaries A/c, wages A/c, interest A/c,

discount A/c etc.

The rule is:

All expenses and losses are –Debit | All incomes and gains are - Credit

110 Office Practice and Accounting 9