Page 152 - Office Practice and Accounting -9

P. 152

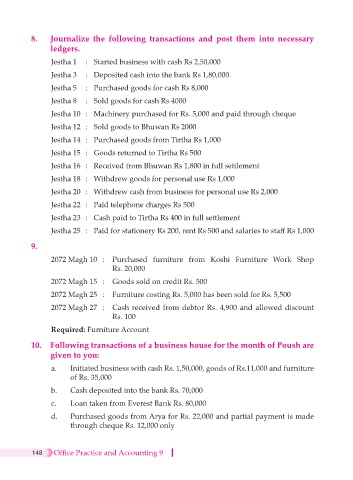

8. Journalize the following transactions and post them into necessary

ledgers.

Jestha 1 : Started business with cash Rs 2,50,000

Jestha 3 : Deposited cash into the bank Rs 1,80,000.

Jestha 5 : Purchased goods for cash Rs 8,000

Jestha 8 : Sold goods for cash Rs 4000

Jestha 10 : Machinery purchased for Rs. 5,000 and paid through cheque

Jestha 12 : Sold goods to Bhuwan Rs 2000

Jestha 14 : Purchased goods from Tirtha Rs 1,000

Jestha 15 : Goods returned to Tirtha Rs 500

Jestha 16 : Received from Bhuwan Rs 1,800 in full settlement

Jestha 18 : Withdrew goods for personal use Rs 1,000

Jestha 20 : Withdrew cash from business for personal use Rs 2,000

Jestha 22 : Paid telephone charges Rs 500

Jestha 23 : Cash paid to Tirtha Rs 400 in full settlement

Jestha 25 : Paid for stationery Rs 200, rent Rs 500 and salaries to staff Rs 1,000

9.

2072 Magh 10 : Purchased furniture from Koshi Furniture Work Shop

Rs. 20,000

2072 Magh 15 : Goods sold on credit Rs. 500

2072 Magh 25 : Furniture costing Rs. 5,000 has been sold for Rs. 5,500

2072 Magh 27 : Cash received from debtor Rs. 4,900 and allowed discount

Rs. 100

Required: Furniture Account

10. Following transactions of a business house for the month of Poush are

given to you:

a. Initiated business with cash Rs. 1,50,000, goods of Rs.11,000 and furniture

of Rs. 35,000

b. Cash deposited into the bank Rs. 70,000

c. Loan taken from Everest Bank Rs. 80,000

d. Purchased goods from Arya for Rs. 22,000 and partial payment is made

through cheque Rs. 12,000 only

148 Office Practice and Accounting 9