Page 160 - Office Practice and Accounting -9

P. 160

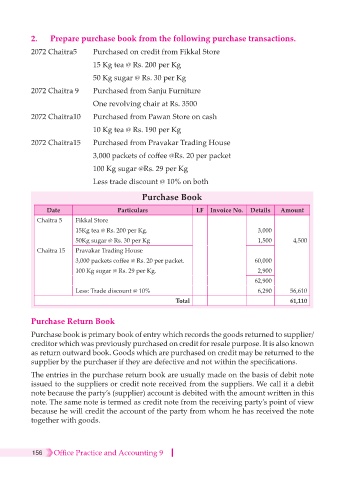

2. Prepare purchase book from the following purchase transactions.

2072 Chaitra5 Purchased on credit from Fikkal Store

15 Kg tea @ Rs. 200 per Kg

50 Kg sugar @ Rs. 30 per Kg

2072 Chaitra 9 Purchased from Sanju Furniture

One revolving chair at Rs. 3500

2072 Chaitra10 Purchased from Pawan Store on cash

10 Kg tea @ Rs. 190 per Kg

2072 Chaitra15 Purchased from Pravakar Trading House

3,000 packets of coffee @Rs. 20 per packet

100 Kg sugar @Rs. 29 per Kg

Less trade discount @ 10% on both

Purchase Book

Date Particulars LF Invoice No. Details Amount

Chaitra 5 Fikkal Store

15Kg tea @ Rs. 200 per Kg. 3,000

50Kg sugar @ Rs. 30 per Kg 1,500 4,500

Chaitra 15 Pravakar Trading House

3,000 packets coffee @ Rs. 20 per packet. 60,000

100 Kg sugar @ Rs. 29 per Kg. 2,900

62,900

Less: Trade discount @ 10% 6,290 56,610

Total 61,110

Purchase Return Book

Purchase book is primary book of entry which records the goods returned to supplier/

creditor which was previously purchased on credit for resale purpose. It is also known

as return outward book. Goods which are purchased on credit may be returned to the

supplier by the purchaser if they are defective and not within the specifications.

The entries in the purchase return book are usually made on the basis of debit note

issued to the suppliers or credit note received from the suppliers. We call it a debit

note because the party’s (supplier) account is debited with the amount written in this

note. The same note is termed as credit note from the receiving party’s point of view

because he will credit the account of the party from whom he has received the note

together with goods.

156 Office Practice and Accounting 9