Page 202 - eBook: EXIM for Beginner

P. 202

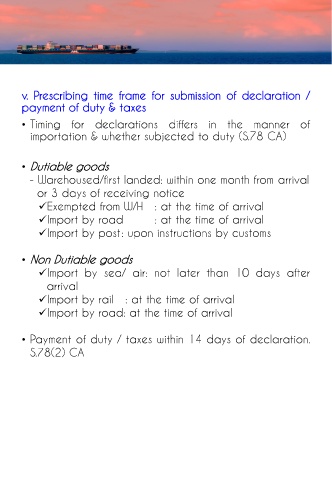

v. Prescribing time frame for submission of declaration /

payment of duty & taxes

• Timing for declarations differs in the manner of

importation & whether subjected to duty (S.78 CA)

• Dutiable goods

- Warehoused/first landed: within one month from arrival

or 3 days of receiving notice

Exempted from W/H : at the time of arrival

Import by road : at the time of arrival

Import by post: upon instructions by customs

• Non Dutiable goods

Import by sea/ air: not later than 10 days after

arrival

Import by rail : at the time of arrival

Import by road: at the time of arrival

• Payment of duty / taxes within 14 days of declaration.

S.78(2) CA