Page 210 - eBook: EXIM for Beginner

P. 210

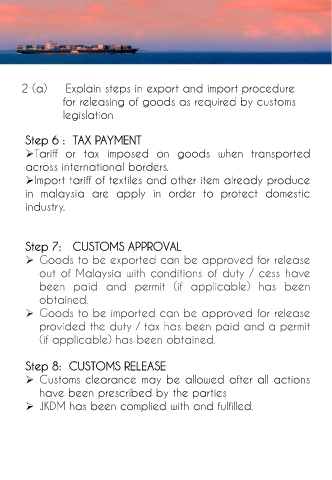

2 (a) Explain steps in export and import procedure

for releasing of goods as required by customs

legislation

Step 6 : TAX PAYMENT

Tariff or tax imposed on goods when transported

across international borders.

Import tariff of textiles and other item already produce

in malaysia are apply in order to protect domestic

industry.

Step 7: CUSTOMS APPROVAL

Goods to be exported can be approved for release

out of Malaysia with conditions of duty / cess have

been paid and permit (if applicable) has been

obtained.

Goods to be imported can be approved for release

provided the duty / tax has been paid and a permit

(if applicable) has been obtained.

Step 8: CUSTOMS RELEASE

Customs clearance may be allowed after all actions

have been prescribed by the parties

JKDM has been complied with and fulfilled.