Page 49 - SU Catalog 2017_18

P. 49

48 Southern Union State Community College Southern Union State Community College 49

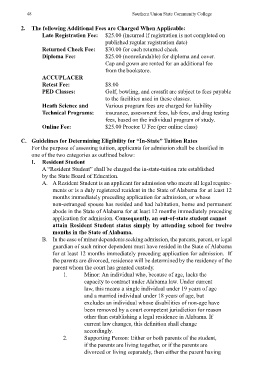

2. The following Additional Fees are Charged When Applicable: legal custody or, if different, the parent providing the

Late Registration Fee: $25.00 (incurred if registration is not completed on greater amount of financial support. If both parents are

published regular registration date) deceased or if neither has legal custody, supporting person

Returned Check Fee: $30.00 for each returned check shall mean, in the following order: the legal custodian of

Diploma Fee: $25.00 (nonrefundable) for diploma and cover. the student, the guardian, and the conservator.

Cap and gown are rented for an additional fee C. In determining Resident Student status for the purpose of charging tuition, the

from the bookstore. burden of proof lies with the applicant for admission.

ACCUPLACER 1. Students having graduated from an Alabama high school

Retest Fee: $8.00 or having obtained a GED in the State of Alabama within

PED Classes: Golf, bowling, and crossfit are subject to fees payable three years of the date of application for admission shall be

to the facilities used in these classes. considered Residential Students for tuition purposes.

Heath Science and Various program fees are charged for liability 2. The in-state tuition rate shall be extended to students who

Technical Programs: insurance, assessment fees, lab fees, and drug testing reside outside of Alabama in a state and county within

fees, based on the individual program of study. fifty (50) miles of a campus of an Alabama Community College

Online Fee: $25.00 Proctor U Fee (per online class) System institution, provided, however, that the campus Information Financial

must have been in existence and operating as of

C. Guidelines for Determining Eligibility for “In-State” Tuition Rates January 1, 1996.

For the purpose of assessing tuition, applicants for admission shall be classified in 3. An individual claiming to be a resident shall certify by a

one of the two categories as outlined below: signed statement each of the following:

I. Resident Student a. A specific address or location within the State

A “Resident Student” shall be charged the in-state-tuition rate established of Alabama as his or her residence.

by the State Board of Education. b. An intention to remain at this address

A. A Resident Student is an applicant for admission who meets all legal require- indefinitely.

ments or is a duly registered resident in the State of Alabama for at least 12 c. Possession of more substantial connections with

months immediately preceding application for admission, or whose the State of Alabama than with any other state.

non-estranged spouse has resided and had habitation, home and permanent 4. Although certification of an address and an intent to

abode in the State of Alabama for at least 12 months immediately preceding remain in the state indefinitely shall be prerequisites to

application for admission. Consequently, an out-of-state student cannot establishing status as a resident, ultimate determination of

attain Resident Student status simply by attending school for twelve that status shall be made by the institution by evaluating

months in the State of Alabama. the presence or absence of connections with the State of

B. In the case of minor dependents seeking admission, the parents, parent, or legal Alabama. The evaluation shall include the consideration

guardian of such minor dependent must have resided in the State of Alabama of the following connections:

for at least 12 months immediately preceding application for admission. If a. Consideration of the location of high school

the parents are divorced, residence will be determined by the residency of the graduation.

parent whom the court has granted custody. b. Payment of Alabama state income taxes as a

1. Minor: An individual who, because of age, lacks the resident.

capacity to contract under Alabama law. Under current c. Ownership of a residence or other real property in

law, this means a single individual under 19 years of age the state and payment of state ad valorem taxes on

and a married individual under 18 years of age, but the residence or property.

excludes an individual whose disabilities of non-age have d. Full-time employment in the state.

been removed by a court competent jurisdiction for reason e. Residence in the state of a spouse, parents, or

other than establishing a legal residence in Alabama. If children.

current law changes, this definition shall change f. Previous periods of residency in the state

accordingly. continuing for one year or more.

2. Supporting Person: Either or both parents of the student, g. Voter registration and voting in the state; more

if the parents are living together, or if the parents are significantly, continuing voter registration in the

divorced or living separately, then either the parent having state that initially occurred at least one year prior