Page 9 - Licona Team Buyer's Guide

P. 9

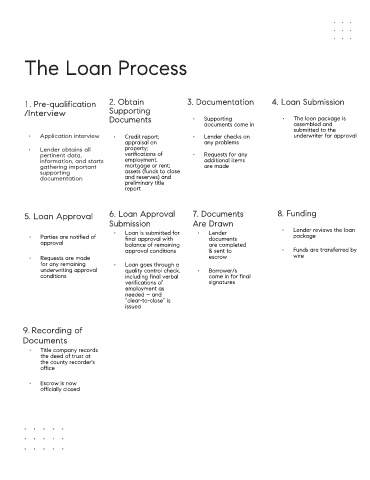

The Loan Process

1. Pre-qualification 2. Obtain 3. Documentation 4. Loan Submission

/Interview Supporting • •

Documents Supporting The loan package is

assembled and

documents come in

submitted to the

• Application interview • Credit report; • Lender checks on underwriter for approval

appraisal on any problems

• Lender obtains all property;

pertinent data, verifications of • Requests for any

information, and starts employment, additional items

gathering important mortgage or rent; are made

supporting assets (funds to close

documentation and reserves) and

preliminary title

report

5. Loan Approval 6. Loan Approval 7. Documents 8. Funding

Submission Are Drawn

• Loan is submitted for • Lender • Lender reviews the loan

• Parties are notified of final approval with documents package

approval balance of remaining are completed

approval conditions & sent to • Funds are transferred by

• Requests are made escrow wire

for any remaining • Loan goes through a

underwriting approval quality control check, • Borrower/s

conditions including final verbal come in for final

verifications of signatures

employment as

needed – and

“clear-to-close” is

issued

9. Recording of

Documents

• Title company records

the deed of trust at

the county recorder's

office

• Escrow is now

officially closed