Page 10 - A-Life_Legasi_Brochure

P. 10

PROTECTION A-Life Legasi

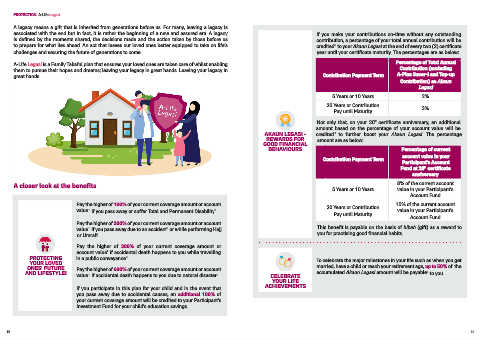

A legacy means a gift that is inherited from generations before us. For many, leaving a legacy is

associated with the end but in fact, it is rather the beginning of a new and assured era. A legacy If you make your contributions on-time without any outstanding

is defined by the moments shared, the decisions made and the action taken by those before us contribution, a percentage of your total annual contribution will be

to prepare for what lies ahead. An act that leaves our loved ones better equipped to take on life’s credited to your Akaun Legasi at the end of every two (2) certificate

6

challenges and securing the future of generations to come. year until your certificate maturity. The percentages are as below:

A-Life Legasi is a Family Takaful plan that ensures your loved ones are taken care of whilst enabling Percentage of Total Annual

them to pursue their hopes and dreams; leaving your legacy in great hands. Leaving your legacy in Contribution (excluding

great hands. Contribution Payment Term A-Plus Saver-i and Top-up

Contribution) as Akaun

Legasi

5 Years or 10 Years 2%

20 Years or Contribution 3%

Pay until Maturity

Not only that, on your 20 certificate anniversary, an additional

th

amount based on the percentage of your account value will be

AKAUN LEGASI - credited to further boost your Akaun Legasi. The percentage

7

REWARDS FOR amount are as below:

GOOD FINANCIAL

BEHAVIOURS Percentage of current

account value in your

Contribution Payment Term

Participant’s Account

Fund at 20 certificate

th

anniversary

A closer look at the benefits 5 Years or 10 Years 8% of the current account

value in your Participant’s

Account Fund

Pay the higher of 100% of your current coverage amount or account 20 Years or Contribution 15% of the current account

value if you pass away or suffer Total and Permanent Disability 2 value in your Participant’s

1

Pay until Maturity

Account Fund

Pay the higher of 200% of your current coverage amount or account

value if you pass away due to an accident or while performing Hajj This benefit is payable on the basis of hibah (gift) as a reward to

3

1

or Umrah 3 you for practising good financial habits.

Pay the higher of 300% of your current coverage amount or

account value if accidental death happens to you while travelling

1

PROTECTING in a public conveyance 3

YOUR LOVED To celebrate the major milestones in your life such as when you get

ONES’ FUTURE Pay the higher of 600% of your current coverage amount or account married, have a child or reach your retirement age, up to 50% of the

5

AND LIFESTYLE! value if accidental death happens to you due to natural disaster 3 CELEBRATE accumulated Akaun Legasi amount will be payable to you.

1

YOUR LIFE

If you participate in this plan for your child and in the event that ACHIEVEMENTS

you pass away due to accidental causes, an additional 100% of

your current coverage amount will be credited to your Participant's

Investment Fund for your child’s education savings.

15 16