Page 22 - Traditions Policies and Procedures

P. 22

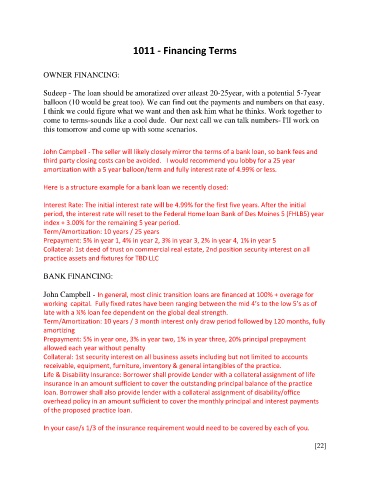

1011 - Financing Terms

OWNER FINANCING:

Sudeep - The loan should be amoratized over atleast 20-25year, with a potential 5-7year

balloon (10 would be great too). We can find out the payments and numbers on that easy.

I think we could figure what we want and then ask him what he thinks. Work together to

come to terms-sounds like a cool dude. Our next call we can talk numbers- I'll work on

this tomorrow and come up with some scenarios.

John Campbell - The seller will likely closely mirror the terms of a bank loan, so bank fees and

third party closing costs can be avoided. I would recommend you lobby for a 25 year

amortization with a 5 year balloon/term and fully interest rate of 4.99% or less.

Here is a structure example for a bank loan we recently closed:

Interest Rate: The initial interest rate will be 4.99% for the first five years. After the initial

period, the interest rate will reset to the Federal Home loan Bank of Des Moines 5 (FHLB5) year

index + 3.00% for the remaining 5 year period.

Term/Amortization: 10 years / 25 years

Prepayment: 5% in year 1, 4% in year 2, 3% in year 3, 2% in year 4, 1% in year 5

Collateral: 1st deed of trust on commercial real estate, 2nd position security interest on all

practice assets and fixtures for TBD LLC

BANK FINANCING:

John Campbell - In general, most clinic transition loans are financed at 100% + overage for

working capital. Fully fixed rates have been ranging between the mid 4’s to the low 5’s as of

late with a ¼% loan fee dependent on the global deal strength.

Term/Amortization: 10 years / 3 month interest only draw period followed by 120 months, fully

amortizing

Prepayment: 5% in year one, 3% in year two, 1% in year three, 20% principal prepayment

allowed each year without penalty

Collateral: 1st security interest on all business assets including but not limited to accounts

receivable, equipment, furniture, inventory & general intangibles of the practice.

Life & Disability Insurance: Borrower shall provide Lender with a collateral assignment of life

insurance in an amount sufficient to cover the outstanding principal balance of the practice

loan. Borrower shall also provide lender with a collateral assignment of disability/office

overhead policy in an amount sufficient to cover the monthly principal and interest payments

of the proposed practice loan.

In your case/s 1/3 of the insurance requirement would need to be covered by each of you.

[22]