Page 35 - Traditions Policies and Procedures

P. 35

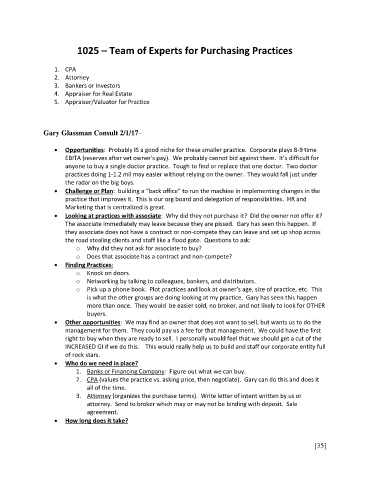

1025 – Team of Experts for Purchasing Practices

1. CPA

2. Attorney

3. Bankers or Investors

4. Appraiser for Real Estate

5. Appraiser/Valuator for Practice

Gary Glassman Consult 2/1/17–

Opportunities: Probably IS a good niche for these smaller practice. Corporate plays 8-9 time

EBITA (reserves after vet owner’s pay). We probably cannot bid against them. It’s difficult for

anyone to buy a single doctor practice. Tough to find or replace that one doctor. Two doctor

practices doing 1-1.2 mil may easier without relying on the owner. They would fall just under

the radar on the big boys.

Challenge or Plan: building a “back office” to run the machine in implementing changes in the

practice that improves it. This is our org board and delegation of responsibilities. HR and

Marketing that is centralized is great.

Looking at practices with associate: Why did they not purchase it? Did the owner not offer it?

The associate immediately may leave because they are pissed. Gary has seen this happen. If

they associate does not have a contract or non-compete they can leave and set up shop across

the road stealing clients and staff like a flood gate. Questions to ask:

o Why did they not ask for associate to buy?

o Does that associate has a contract and non-compete?

Finding Practices:

o Knock on doors.

o Networking by talking to colleagues, bankers, and distributors.

o Pick up a phone book. Plot practices and look at owner’s age, size of practice, etc. This

is what the other groups are doing looking at my practice. Gary has seen this happen

more than once. They would be easier sold, no broker, and not likely to look for OTHER

buyers.

Other opportunities: We may find an owner that does not want to sell, but wants us to do the

management for them. They could pay us a fee for that management. We could have the first

right to buy when they are ready to sell. I personally would feel that we should get a cut of the

INCREASED GI if we do this. This would really help us to build and staff our corporate entity full

of rock stars.

Who do we need in place?

1. Banks or Financing Company: Figure out what we can buy.

2. CPA (values the practice vs. asking price, then negotiate). Gary can do this and does it

all of the time.

3. Attorney (organizes the purchase terms). Write letter of intent written by us or

attorney. Send to broker which may or may not be binding with deposit. Sale

agreement.

How long does it take?

[35]