Page 35 - Jignyasa-June 2020

P. 35

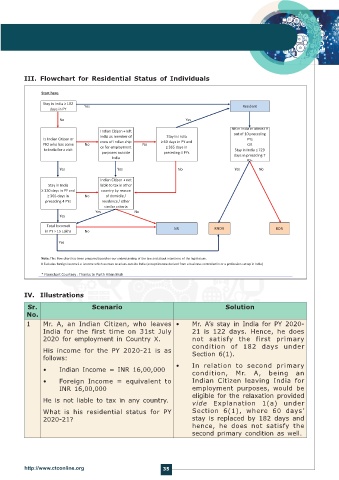

III. Flowchart for Residential Status of Individuals

VII. FLOWCHART FOR RESIDENTIAL STATUS OF INDIVIDUALS *

Start here

Stay in India ≥ 182 Yes Resident

days in PY

No Yes

NR in India in atleast 9

Indian Citizen + left

India as member of Stay in India out of 10 preceding

Is Indian Citizen or PYs

PIO who has come No crew of Indian ship No ≥ 60 days in PY and OR

to India for a visit or for employment ≥ 365 days in Stay in India ≤ 729

purposes outside preceding 4 PYs days in preceding 7

India

PYs

Yes Yes No Yes No

Indian Citizen + not

Stay in India liable to tax in other

≥ 120 days in PY and country by reason

≥ 365 days in No of domicile /

preceding 4 PYs residence / other

similar criteria

Yes No

Yes

Total Income# RNOR

in PY > 15 Lakhs No NR ROR

Yes

Note: This flow chart has been prepared based on our understanding of the law and about intentions of the legislature.

# Excludes foreign income i.e .income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India)

* Flowchart Courtesy : Thanks to Parth Hiten Shah

IV. Illustrations

Sr. Scenario Solution

No.

1 Mr. A, an Indian Citizen, who leaves • Mr. A’s stay in India for PY 2020-

India for the first time on 31st July 21 is 122 days. Hence, he does

2020 for employment in Country X. not satisfy the first primary

condition of 182 days under

His income for the PY 2020-21 is as Section 6(1).

follows:

• In relation to second primary

• Indian Income = INR 16,00,000

condition, Mr. A, being an

• Foreign Income = equivalent to Indian Citizen leaving India for

INR 16,00,000 employment purposes, would be

eligible for the relaxation provided

He is not liable to tax in any country. vide Explanation 1(a) under

What is his residential status for PY Section 6(1), where 60 days’

2020-21? stay is replaced by 182 days and

hence, he does not satisfy the

second primary condition as well.

http://www.ctconline.org 35