Page 39 - Forbes - Asia (October 2019)

P. 39

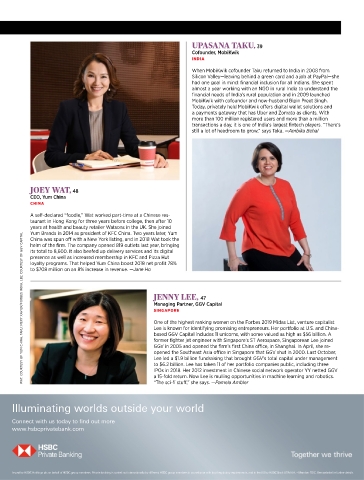

UPASANA TAKU, 39

Cofounder, MobiKwik

INDIA

When MobiKwik cofounder Taku returned to India in 2008 from

Silicon Valley—leaving behind a green card and a job at PayPal—she

had one goal in mind: financial inclusion for all Indians. She spent

almost a year working with an NGO in rural India to understand the

financial needs of India’s rural population and in 2009 launched

MobiKwik with cofounder and now-husband Bipin Preet Singh.

Today, privately held MobiKwik offers digital wallet solutions and

a payments gateway that has Uber and Zomato as clients. With

more than 100 million registered users and more than a million

transactions a day, it is one of India’s largest fintech players. “There’s

still a lot of headroom to grow,” says Taku. —Ambika Behal

JOEY WAT, 48

CEO, Yum China

CHINA

A self-declared “foodie,” Wat worked part-time at a Chinese res-

taurant in Hong Kong for three years before college, then after 10

years at health and beauty retailer Watsons in the UK. She joined

Yum Brands in 2014 as president of KFC China. Two years later, Yum

WAT: COURTESY OF YUM CHINA, TAKU: MEXY XAVIER/FORBES INDIA, LEE: COURTESY OF GGV CAPITAL

China was spun off with a New York listing, and in 2018 Wat took the

helm of the firm. The company opened 819 outlets last year, bringing

its total to 8,600. It also beefed up delivery services and its digital

presence as well as increased membership in KFC and Pizza Hut

loyalty programs. That helped Yum China boost 2018 net profit 78%

to $708 million on an 8% increase in revenue. —Jane Ho

JENNY LEE, 47

Managing Partner, GGV Capital

SINGAPORE

One of the highest ranking women on the Forbes 2019 Midas List, venture capitalist

Lee is known for identifying promising entrepreneurs. Her portfolio at U.S. and China-

based GGV Capital includes 11 unicorns, with some valued as high as $56 billion. A

former fighter jet engineer with Singapore’s ST Aerospace, Singaporean Lee joined

GGV in 2005 and opened the firm’s first China office, in Shanghai. In April, she re-

opened the Southeast Asia office in Singapore that GGV shut in 2000. Last October,

Lee led a $1.9 billion fundraising that brought GGV’s total capital under management

to $6.2 billion. Lee has taken 11 of her portfolio companies public, including three

IPOs in 2018. Her 2012 investment in Chinese social network operator YY netted GGV

a 15-fold return. Now Lee is mulling opportunities in machine learning and robotics.

“The sci-fi stuff,” she says. —Pamela Ambler

Illuminating worlds outside your world

Connect with us today to find out more

www.hsbcprivatebank.com

Issued by HSBC Holdings plc on behalf of HSBC group members. Private banking is carried out internationally by different HSBC group members in accordance with local regulatory requirements, and in the US by HSBC Bank USA N.A. – Member FDIC. See website for further details.