Page 24 - MBA curriculum and syllabus R2017 - REC

P. 24

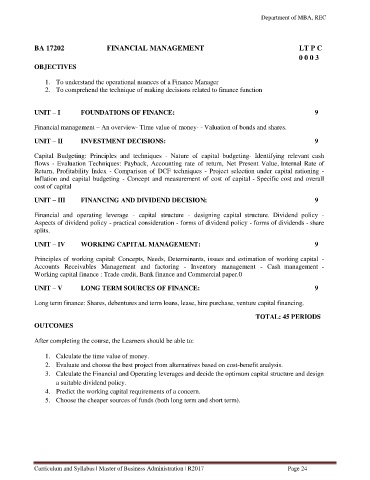

Department of MBA, REC

BA 17202 FINANCIAL MANAGEMENT LT P C

0 0 0 3

OBJECTIVES

1. To understand the operational nuances of a Finance Manager

2. To comprehend the technique of making decisions related to finance function

UNIT – I FOUNDATIONS OF FINANCE: 9

Financial management – An overview- Time value of money- - Valuation of bonds and shares.

UNIT – II INVESTMENT DECISIONS: 9

Capital Budgeting: Principles and techniques - Nature of capital budgeting- Identifying relevant cash

flows - Evaluation Techniques: Payback, Accounting rate of return, Net Present Value, Internal Rate of

Return, Profitability Index - Comparison of DCF techniques - Project selection under capital rationing -

Inflation and capital budgeting - Concept and measurement of cost of capital - Specific cost and overall

cost of capital

UNIT – III FINANCING AND DIVIDEND DECISION: 9

Financial and operating leverage - capital structure - designing capital structure. Dividend policy -

Aspects of dividend policy - practical consideration - forms of dividend policy - forms of dividends - share

splits.

UNIT – IV WORKING CAPITAL MANAGEMENT: 9

Principles of working capital: Concepts, Needs, Determinants, issues and estimation of working capital -

Accounts Receivables Management and factoring - Inventory management - Cash management -

Working capital finance : Trade credit, Bank finance and Commercial paper.0

UNIT – V LONG TERM SOURCES OF FINANCE: 9

Long term finance: Shares, debentures and term loans, lease, hire purchase, venture capital financing.

TOTAL: 45 PERIODS

OUTCOMES

After completing the course, the Learners should be able to:

1. Calculate the time value of money.

2. Evaluate and choose the best project from alternatives based on cost-benefit analysis.

3. Calculate the Financial and Operating leverages and decide the optimum capital structure and design

a suitable dividend policy.

4. Predict the working capital requirements of a concern.

5. Choose the cheaper sources of funds (both long term and short term).

Curriculum and Syllabus | Master of Business Administration | R2017 Page 24