Page 23 - gmj144-July-Sept-mag-web

P. 23

REFINING THE GOLD STANDARD abcrefinery.com

DFS was based on a 702,000oz

mining inventory but plans are

already in place to expand to more

than 875,000oz with the inclusion

of the Blue Spec underground

project.

In late June, the company

announced diamond drilling had

started at Blue Spec ahead of an

updated DFS for mining of the

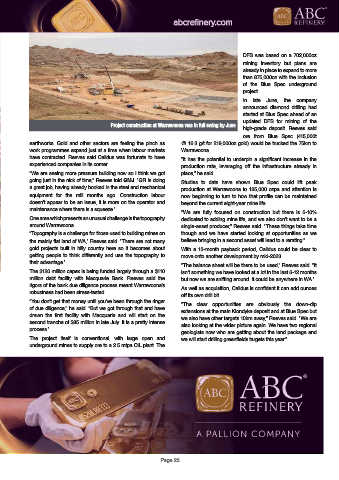

Project construction at Warrawoona was in full swing by June

high-grade deposit. Reeves said

ore from Blue Spec (415,000t

earthworks. Gold and other sectors are feeling the pinch as @ 16.3 g/t for 219,000oz gold) would be trucked the 75km to

work programmes expand just at a time when labour markets Warrawoona.

have contracted. Reeves said Calidus was fortunate to have “It has the potential to underpin a significant increase in the

experienced companies in its corner. production rate, leveraging off the infrastructure already in

“We are seeing more pressure building now so I think we got place,” he said.

going just in the nick of time,” Reeves told GMJ. “GR is doing Studies to date have shown Blue Spec could lift peak

a great job, having already booked in the steel and mechanical production at Warrawoona to 135,000 ozpa and attention is

equipment for the mill months ago. Construction labour now beginning to turn to how that profile can be maintained

doesn’t appear to be an issue, it is more on the operator and beyond the current eight-year mine life.

maintenance where there is a squeeze.”

“We are fully focused on construction but there is 5-10%

One area which presents an unusual challenge is the topography dedicated to adding mine life, and we also don’t want to be a

around Warrawoona. single-asset producer,” Reeves said. “These things take time

“Topography is a challenge for those used to building mines on though and we have started looking at opportunities as we

the mainly flat land of WA,” Reeves said. “There are not many believe bringing in a second asset will lead to a rerating.”

gold projects built in hilly country here so it becomes about With a 13-month payback period, Calidus could be clear to

getting people to think differently and use the topography to move onto another development by mid-2023.

their advantage.”

“The balance sheet will be there to be used,” Reeves said. “It

The $120 million capex is being funded largely through a $110 isn’t something we have looked at a lot in the last 6-12 months

million debt facility with Macquarie Bank. Reeves said the but now we are sniffing around. It could be anywhere in WA.”

rigors of the bank due diligence process meant Warrawoona’s

As well as acquisition, Calidus is confident it can add ounces

robustness had been stress-tested.

off its own drill bit.

“You don’t get that money until you’ve been through the ringer

“The clear opportunities are obviously the down-dip

of due diligence,” he said. “But we got through that and have

extensions at the main Klondyke deposit and at Blue Spec but

drawn the first facility with Macquarie and will start on the

we also have other targets 10km away,” Reeves said. “We are

second tranche of $85 million in late July. It is a pretty intense

also looking at the wider picture again. We have two regional

process.”

geologists now who are getting about the land package and

The project itself is conventional, with large open and we will start drilling greenfields targets this year.”

underground mines to supply ore to a 2.5 mtpa CIL plant. The

Leading the Precious Metal Refining Industry

with Innovation & Technology

abcrefinery.com

Page 23