Page 12 - gmj145-Oct-Dec-mag-web_Neat

P. 12

NEWS

Star shoots

to IPO

by Fraser Palamara

tar Minerals Ltd is the latest among a throng of gold

Shopefuls looking to capitalise on strong spot prices

amid a busy IPO pipeline.

The spin-out of Bryah Resources Ltd hit a major gust of

wind when Magnolia Capital splurged half of the $5 million

raising bill. Star now takes the “mine-ready” Tumblegum Tumblegum South is one of many “mine-ready” projects being

South deposit and the West Bryah exploration project, both revived due to the bullish gold price

near Meekatharra, from its parent company for $500,000 in

cash, 9 million in shares and 7 million in performance rights. “We’ll get the first rig up there and then we’ll see how we’re

Tumblegum has its mining lease approved, remains on track placed,” he told GMJ. “And if we need to throw another one

for an ESIA application and holds an inferred resource of at it to get things done, then we’ll look at that as well. But

600,000t @ 2.2 g/t gold for 42,500oz, plus some untapped it’s just one rig at this stage, otherwise we have to man up a

copper potential. whole lot more to support a much bigger programme.”

Star chief executive Greg Almond, formerly a principal Set to debut on the ASX at the time of print, Star joins an

geologist for Fortescue Metals Group Ltd, said Tumblegum’s extremely bullish environment for exploration spend with

ore quality could be lifted for hungry buyers. companies fighting over drill rigs and personnel in a tight

labour market, especially in Western Australia. The June

“We’ve had a number of discussions with parties around ore

quarter saw $878.3 million spent in the resources sector, a

sales and development agreements, we’ve got a number of

rise of 3.7% from the previous period.

people very interested in our material,” Almond said. “We’re

pretty confident that we can get around 2.8-3.2 g/t product Much of this spend has been attributed to investors looking

out. to capitalise on the strong commodity prices which helped

prop up the financial markets throughout the pandemic,

“I genuinely believe that we’re going to see a very steady, if

while also giving rise to a record-breaking number of IPOs

not slightly increased gold price for quite some time as well.

seeking to revive old ground.

Copper is also at record highs and that’s going to continue

as we see the move to further electrification over fossil fuels Tumblegum was originally mined from 1987 to 1992, but

in the energy space.” closed when gold prices dropped. Much of the ground was

also originally mined for copper, leaving a blind spot open

In its freshman year, Star will spend $3.23 million on RC

for modern gold exploration.

drilling at Tumblegum while West Bryah undergoes soil

sampling, RAB and RC drilling. A similar schedule will be While Star is focused on Tumblegum in the short term,

followed in the second year for a $1.8 million spend. Almond said the surprise investment from Magnolia –

and the firepower it brings to the table – would create

Almond said Tumblegum will serve as the company’s “war

opportunities down the road for a larger portfolio.

chest”, using the funds to advance exploration at West

Bryah and potential future acquisitions. “With Magnolia, we provide ourselves with a little bit more

support from a big reputable group of guys

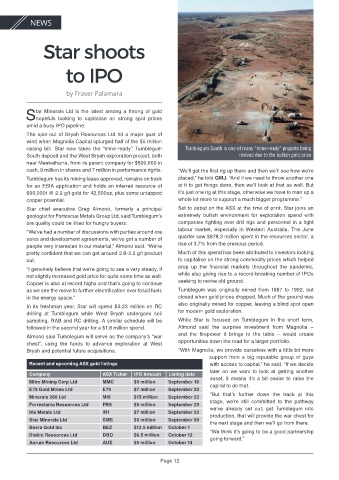

Recent and upcoming ASX gold listings with access to capital,” he said. “If we decide

later on we want to look at getting another

Company ASX Ticker IPO Amount Listing date

asset, it means it’s a bit easier to raise the

Mitre Mining Corp Ltd MMC $5 million September 10

capital to do that.

E79 Gold Mines Ltd E79 $7 million September 22

“But that’s further down the track at this

Minerals 260 Ltd MI6 $15 million September 22

stage, we’re still committed to the pathway

Forrestania Resources Ltd FRS $5 million September 23

we’ve already set out; get Tumblegum into

Iris Metals Ltd IR1 $7 million September 23

production, that will provide the war chest for

Star Minerals Ltd SMS $5 million September 30

the next stage and then we’ll go from there.

Besra Gold Inc BEZ $12.5 million October 1

“We think it’s going to be a good partnership

Diablo Resources Ltd DBO $6.5 million October 12

going forward.”

Aurum Resources Ltd AUE $5 million October 14

Page 12