Page 143 - SYU Prospectus

P. 143

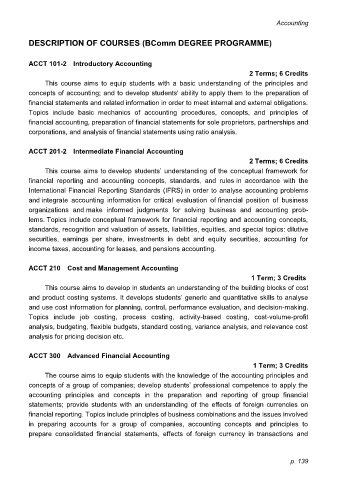

Accounting

DESCRIPTION OF COURSES (BComm DEGREE PROGRAMME)

ACCT 101-2 Introductory Accounting

2 Terms; 6 Credits

This course aims to equip students with a basic understanding of the principles and

concepts of accounting; and to develop students' ability to apply them to the preparation of

financial statements and related information in order to meet internal and external obligations.

Topics include basic mechanics of accounting procedures, concepts, and principles of

financial accounting, preparation of financial statements for sole proprietors, partnerships and

corporations, and analysis of financial statements using ratio analysis.

ACCT 201-2 Intermediate Financial Accounting

2 Terms; 6 Credits

This course aims to develop students’ understanding of the conceptual framework for

financial reporting and accounting concepts, standards, and rules in accordance with the

International Financial Reporting Standards (IFRS) in order to analyse accounting problems

and integrate accounting information for critical evaluation of financial position of business

organizations and make informed judgments for solving business and accounting prob-

lems. Topics include conceptual framework for financial reporting and accounting concepts,

standards, recognition and valuation of assets, liabilities, equities, and special topics: dilutive

securities, earnings per share, investments in debt and equity securities, accounting for

income taxes, accounting for leases, and pensions accounting.

ACCT 210 Cost and Management Accounting

1 Term; 3 Credits

This course aims to develop in students an understanding of the building blocks of cost

and product costing systems. It develops students’ generic and quantitative skills to analyse

and use cost information for planning, control, performance evaluation, and decision-making.

Topics include job costing, process costing, activity-based costing, cost-volume-profit

analysis, budgeting, flexible budgets, standard costing, variance analysis, and relevance cost

analysis for pricing decision etc.

ACCT 300 Advanced Financial Accounting

1 Term; 3 Credits

The course aims to equip students with the knowledge of the accounting principles and

concepts of a group of companies; develop students’ professional competence to apply the

accounting principles and concepts in the preparation and reporting of group financial

statements; provide students with an understanding of the effects of foreign currencies on

financial reporting. Topics include principles of business combinations and the issues involved

in preparing accounts for a group of companies, accounting concepts and principles to

prepare consolidated financial statements, effects of foreign currency in transactions and

p. 139