Page 3 - 401K Matrix

P. 3

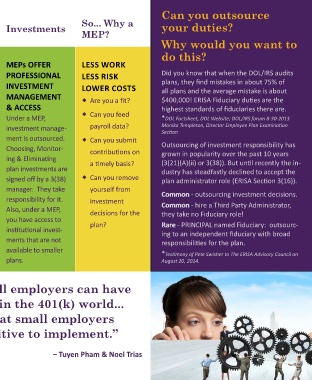

Can you outsource

So... Why a

Investments your duties?

MEP?

Why would you want to

do this?

MEPs OFFER LESS WORK

PROFESSIONAL LESS RISK Did you know that when the DOL/IRS audits

INVESTMENT LOWER COSTS plans, they find mistakes in about 75% of

MANAGEMENT ® Are you a fit? all plans and the average mistake is about

$400,000! ERISA Fiduciary duties are the

& ACCESS highest standards of fiduciaries there are.

Under a MEP, ® Can you feed *DOL Factsheet, DOL Website; DOL/IRS forum 8-30-2013

investment manage- payroll data? Monika Templeton, Director Employee Plan Examination

Section

ment is outsourced. ® Can you submit

Choosing, Monitor- contributions on Outsourcing of investment responsibility has

grown in popularity over the past 10 years

ing & Eliminating a timely basis? (3(21)(A)(ii) or 3(38)). But until recently the in-

plan investments are dustry has steadfastly declined to accept the

signed off by a 3(38) ® Can you remove plan administrator role (ERISA Section 3(16)).

manager. They take yourself from Common - outsourcing investment decisions.

responsibility for it. investment

Also, under a MEP, decisions for the Common - hire a Third Party Administrator,

they take no Fiduciary role!

you have access to plan? Rare - PRINCIPAL named Fiduciary: outsourc-

institutional invest- ing to an independent fiduciary with broad

ments that are not responsibilities for the plan.

available to smaller *Testimony of Pete Swisher to The ERISA Advisory Council on

plans. August 20, 2014.

“We designed The 401(k) Matrix MEP so that small employers can have

the many advantages that large employers enjoy in the 401(k) world...

This means access to services and investments that small employers

may not be able to get or that are too cost prohibitive to implement.”

– Tuyen Pham & Noel Trias