Page 16 - 21 Summer Newsletter

P. 16

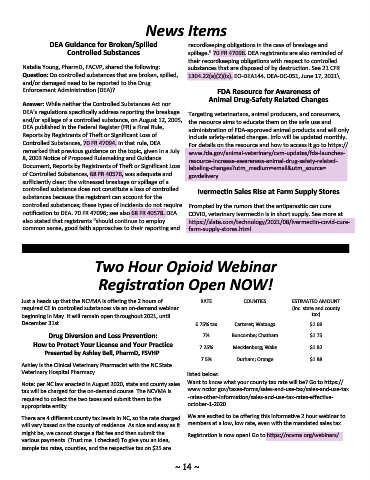

News Items

DEA Guidance for Broken/Spilled recordkeeping obligations in the case of breakage and

Controlled Substances spillage." 70 FR 47096. DEA registrants are also reminded of

their recordkeeping obligations with respect to controlled

Natalie Young, PharmD, FACVP, shared the following: substances that are disposed of by destruction. See 21 CFR

Question: Do controlled substances that are broken, spilled, 1304.22(a)(2)(ix). EO‐DEA144. DEA‐DC‐051, June 17, 2021\

and/or damaged need to be reported to the Drug

Enforcement Administration (DEA)? FDA Resource for Awareness of

Animal Drug‐Safety Related Changes

Answer: While neither the Controlled Substances Act nor

DEA's regulations specifically address reporting the breakage Targeting veterinarians, animal producers, and consumers,

and/or spillage of a controlled substance, on August 12, 2005, the resource aims to educate them on the safe use and

DEA published in the Federal Register (FR) a Final Rule, administration of FDA‐approved animal products and will only

Reports by Registrants of Theft or Significant Loss of include safety‐related changes. Info will be updated monthly.

Controlled Substances, 70 FR 47094. In that rule, DEA For details on the resource and how to access it go to https://

remarked that previous guidance on the topic, given in a July www.fda.gov/animal‐veterinary/cvm‐updates/fda‐launches‐

8, 2003 Notice of Proposed Rulemaking and Guidance resource‐increase‐awareness‐animal‐drug‐safety‐related‐

Document, Reports by Registrants of Theft or Significant Loss labeling‐changes?utm_medium=email&utm_source=

of Controlled Substances, 68 FR 40576, was adequate and govdelivery

sufficiently clear: the witnessed breakage or spillage of a

controlled substance does not constitute a loss of controlled Ivermectin Sales Rise at Farm Supply Stores

substances because the registrant can account for the

controlled substances; these types of incidents do not require Prompted by the rumors that the antiparasitic can cure

notification to DEA. 70 FR 47096; see also 68 FR 40578. DEA COVID, veterinary ivermectin is in short supply. See more at

also stated that registrants "should continue to employ https://slate.com/technology/2021/08/ivermectin‐covid‐cure‐

common sense, good faith approaches to their reporting and farm‐supply‐stores.html

Two Hour Opioid Webinar

Registration Open NOW!

Just a heads up that the NCVMA is offering the 2 hours of RATE COUNTIES ESTIMATED AMOUNT

required CE in controlled substances via an on‐demand webinar (inc. state and county

beginning in May. It will remain open throughout 2021, until tax)

December 31st. 6.75% tax Carteret; Watauga $1.69

Drug Diversion and Loss Prevention: 7% Buncombe; Chatham $1.75

How to Protect Your License and Your Practice 7.25% Mecklenburg; Wake $1.82

Presented by Ashley Bell, PharmD, FSVHP

7.5% Durham; Orange $1.88

Ashley is the Clinical Veterinary Pharmacist with the NC State

Veterinary Hospital Pharmacy. listed below:

Note: per NC law enacted in August 2020, state and county sales Want to know what your county tax rate will be? Go to https://

tax will be charged for the on‐demand course. The NCVMA is www.ncdor.gov/taxes‐forms/sales‐and‐use‐tax/sales‐and‐use‐tax

required to collect the two taxes and submit them to the ‐rates‐other‐information/sales‐and‐use‐tax‐rates‐effective‐

appropriate entity. october‐1‐2020

There are 4 different county tax levels in NC, so the rate charged We are excited to be offering this informative 2 hour webinar to

will vary based on the county of residence. As nice and easy as it members at a low, low rate, even with the mandated sales tax.

might be, we cannot charge a flat fee and then submit the Registration is now open! Go to https://ncvma.org/webinars/

various payments. (Trust me. I checked) To give you an idea,

sample tax rates, counties, and the respective tax on $25 are

~ 14 ~