Page 52 - ESA IC News April

P. 52

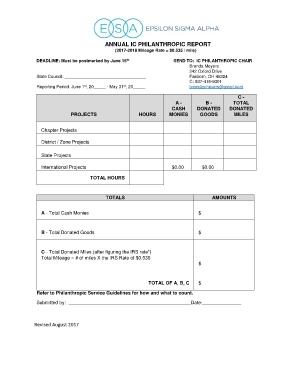

ANNUAL IC PHILANTHROPIC REPORT

(2017-2018 Mileage Rate = $0.535 / mile)

DEADLINE: Must be postmarked by June 15 th SEND TO: IC PHILANTHROPIC CHAIR

Brenda Meyers

242 Oxford Drive

State Council: __________________________________ Fairborn, OH 45324

C: 937-416-9301

st

st

Reporting Period: June 1 , 20_____ - May 31 , 20_____ brendasmeyers@gmail.com

C -

A - B - TOTAL

CASH DONATED DONATED

PROJECTS HOURS MONIES GOODS MILES

Chapter Projects

District / Zone Projects

State Projects

International Projects $0.00 $0.00

TOTAL HOURS

TOTALS AMOUNTS

A - Total Cash Monies $

B - Total Donated Goods $

C - Total Donated Miles (after figuring the IRS rate*)

Total Mileage = # of miles X the IRS Rate of $0.535

$

TOTAL OF A, B, C $

Refer to Philanthropic Service Guidelines for how and what to count.

Submitted by: Date:

Revised August 2017