Page 23 - BoAML Plan Handbook 17 V2.0

P. 23

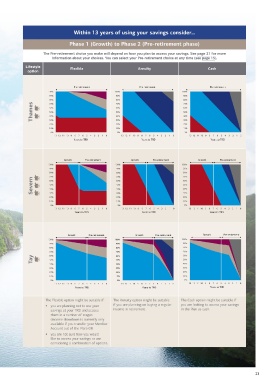

More than 13 years from using your savings consider… Within 13 years of using your savings consider…

Phase 1 (Growth phase) Phase 1 (Growth) to Phase 2 (Pre-retirement phase)

The Lifestyle choice you make will depend on your attitude to risk. You can change your investment choice at any time (see page 15). The Pre-retirement choice you make will depend on how you plan to access your savings. See page 21 for more

information about your choices. You can select your Pre-retirement choice at any time (see page 15).

Lifestyle Aims to Choose this option if you… How your Member Account moves between Lifestyle Flexible Annuity Cash

option funds during the Growth phase option

Achieve growth through …are happy to take a higher

investing fully in equities level of investment risk in

Pre-retirement

until 20 years before TRD. order to achieve a potentially Growth Growth Growth Pre-retirement Pre-retirement Pre-retirement Pre-retirement Pre-retirement Pre-retirement

Pre-retirement

Growth

Pre-retirement

Pre-retirement

Pre-retirement

Pre-retirement

This equity investment is higher level of growth up until 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

then gradually moved into 20 years before your TRD. 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90%

diversified investments still 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80%

Thames potential growth, but with the 60% 60% 60% 60% 60% Thames 60% 60% 60% 60% 60% 60% 60% 60% 60% 60% 60%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

70%

with the objective of achieving

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

additional aim of reducing

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

the volatility of being fully

invested in equities. 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

From 13 years before TRD the 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

funds you go into will depend 30+ 29 28 27 26 25 24 23 22 21 20 30+ 29 18 28 17 30+ 29 27 25 14 27 25 23 25 23 21 23 21 19 21 19 17 9 18 16 14 6 16 14 4 14 3 2 13 1 0 13 12 13 1211 10 13 12 11 1011 109 8 9 13 12 11 10787 6 97 5 86 4 5 9 643 8 532 7 421 6 310 5 20 4 1 3 0 2 1 0 13 12 13 1211 10 13 12 11 1011 109 8 9 13 12 11 10787 6 97 5 86 4 5 9 643 8 532 7 421 6 310 5 20 4 1 3 0 2 1 0 13 12 13 1211 10 13 12 11 1011 109 8 9 7

28

16 26

15 28 26 24

13 26 24 22

24 22 20

20 18 16

815

7 17 15 13

13 12 11 10 19 17

22 20 18

5 15 13

19 30+ 29 27

on your choice of outcome Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD

Years to TRD

Years to TRD

Years to TRD

Years to TRD

Years to TRD

(see Phase 2).

Achieve growth through …are happy to take a higher

investing fully in equities level of investment risk in

Pre-retirement

Pre-retirement

GrowthPre-retirement

GrowthPre-retirement

Pre-retirement

Pre-retirement

until 10 years before TRD. exchange for the greater Growth Growth Growth Growth Growth Pre-retirement Growth Growth Growth Pre-retirement Pre-retirement Growth Growth Growth Pre-retirement Pre-retirement Growth Growth Growth Pre-retirement

The equity investment is potential for growth offered 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

90%

90%

90%

90%

then gradually moved into by equities until 10 years 80% 80% 80% 80% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90%

80%

80%

80%

80%

80%

80%

80%

80%

80%

80%

80%

80%

diversified investments, still from your TRD. 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70%

Severn potential growth, but with the 60% 60% 60% 60% 60% Severn 60% 60% 60% 60% 60% 60% 60% 60% 60% 60% 60%

with the objective of achieving

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

50%

additional aim of reducing

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

40%

the volatility of being fully

20%

invested in equities. 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% 30%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

20%

10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

From seven years before 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

0

22 20

TRD the funds you go into will 30+ 29 28 27 26 25 24 23 22 21 20 30+ 19 30+ 2929 18 28 1730+2827 1629 2726 1528 2625 1427 2524 1326 2423 25 2322 24 2221 23 2120 13 12 11 10 19 1719 21 1918 20 1817 9 18 1616 815 7 17 1514 6 16 1413 5 15 13 3 2 13 1 13 12 13 1211 10 13 12 11 1011 109 8 9 13 12 11 10787 6 9 7 5 8 6 4 5 9 6 43 8 5 32 7 4 21 6 3 10 5 2 0 4 1 3 0 2 1 13 12 13 1211 10 13 12 11 1011 109 8 9 13 12 11 10787 6 9 7 5 8 6 4 5 9 6

0

4 14

Years to TRD

Years to TRD

Years to TRD

Years to TRD

Years to TRD

Years to TRD

depend on your choice Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD

of outcome (see Phase 2).

Achieve growth through …are less comfortable with

exclusively diversified short-term volatility often

investments until 15 years associated with equity Growth Growth Growth Growth Growth Pre-retirement Growth Growth Growth Pre-retirement Pre-retirement Growth Growth Growth Pre-retirement Pre-retirement Growth Growth Pre-retirement

Growth Pre-retirementPre-retirement

Growth

Pre-retirement

Growth Pre-retirementPre-retirement

Pre-retirement

before TRD. It provides investments, and prefer the 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

potential growth over the long lower volatility of diversified 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90% 90%

term while reducing volatility investments. You accept 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80% 80%

when compared to fully that this may reduce the 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70% 70%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

60%

Tay investing in equities. overall potential for growth, 50% 50% 50% 50% 50% Tay 50% 50% 50% 50% 50% 50% 50% 50% 50% 50% 50%

compared to what equities

could provide. 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40% 40%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

30%

20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20%

10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

13 12 11 10 8

9 7

9

19 30+ 29 27

7 17 15 13

9

9 64 2

13 12 11 1078 6

9 1817 15

1427 25 23

1629 27 25

25 23 21

21 19 17

23 21 19

13 12 11 1078 6

9

9 64 2

5 15

13 12

0

6 31

13 12

22

6 31

30+ 29 28 27 26 25 24 23 22 21 20 30+ 29 18 28 1730+28 26 1528 26 24 1326 24 22 24 22 20 13 12 11 10 1920 18 20 18 16 8 16 14 6 16 14 4 1413 3 2 13 1 13 12 11 10 13 12 11 1011 10 8 9 7 97 5 86 4 5 3 8 53 1 7 42 0 5 20 4 1 3 0 2 1 13 12 11 10 13 12 11 1011 10 8 9 7 97 5 86 4 5 3 8 53 1 7 42 0 5 20 4 1 3 0 2 1 0 13 12 11 10 13 12 11 10 8 6 97 5 86 4 75 3 64 2 53 1 42 0 31 20 1 0

0

Years to TRD

Years to TRD

Years to TRD

Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD Years to TRD

Years to TRD

Years to TRD

Years to TRD

The Flexible option might be suitable if: The Annuity option might be suitable The Cash option might be suitable if

The Lifestyle default approach Key • you are planning not to use your if you are planning on buying a regular you are looking to access your savings

savings at your TRD and access income in retirement. in the Plan as cash.

If you do not make an active decision as to how to invest your Member Account, Equity Lifestyle Fund them in a number of stages

it will automatically be invested in the Lifestyle – Thames approach, following the Diversified Lifestyle Fund (income drawdown is currently only

Flexible option during the Pre-retirement phase. Corporate Bond Lifestyle Fund available if you transfer your Member

Account out of the Plan) OR

You need to carefully consider if this is the right choice for you. Index-Linked Gilt Lifestyle Fund

Pre-Retirement Lifestyle Fund • you are not sure how you would

like to access your savings or are

Money Market Lifestyle Fund considering a combination of options.

Level of risk

22 23