Page 25 - BoAML Plan Handbook 17 V2.0

P. 25

Freestyle

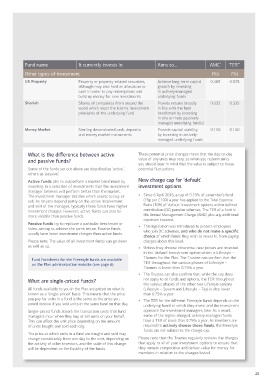

The Freestyle funds are summarised below.

The name of each fund describes the asset class in which it invests, or the principles on which it is based. It means that the Trustee * **

can monitor and manage the funds, and make any necessary changes (if the Trustee considers that changes are appropriate) quickly Fund name It currently invests in Aims to… AMC TER

and efficiently. See page 26 to read more about the different asset classes. Other types of investment (%) (%)

UK Property Property or property-related securities, Achieve long-term capital 0.485 0.525

Fund name It currently invests in Aims to… AMC * TER ** although may also hold an allocation to growth by investing

Equities (active) (%) (%) cash in order to pay redemptions and in actively-managed

build up money for new investments underlying funds

Emerging Markets Equity Shares of companies in countries, Achieve long-term capital 0.835 0.970 Shariah Shares of companies from around the Provide returns broadly 0.035 0.335

designated as emerging markets growth by investing world which meet the Islamic investment in line with the fund

Global Equity Shares of companies around the world in actively-managed 0.622 0.699 principles of the underlying fund benchmark by investing

UK Equity Shares of companies in the UK underlying funds 0.477 0.603 in one or more passively-

managed underlying fund(s)

Diversified assets (%) (%)

Money Market Sterling denominated cash, deposits Provide capital stability 0.150 0.150

A range of asset classes including equities, Achieve long-term capital 0.635 0.683 and money market instruments by investing in actively-

bonds, property, commodities, hedge growth by investing managed underlying funds

Diversified Growth

funds, derivatives and cash/currencies in actively-managed

around the world underlying funds

What is the difference between active These potential price changes mean that the day-to-day

Equities (passive) (%) (%) value of any units may vary, so when you redeem units

and passive funds?

Asia Pacific (ex-Japan) Equity Shares of companies in the Asia Pacific 0.085 0.099 you should bear in mind that the value is subject to these

region excluding Japan Some of the funds set out above are described as ‘active’, potential fluctuations.

others as ‘passive’.

Ethical Global Equity Shares of companies that are selected 0.335 0.335

based on the socially responsible investing Active funds aim to outperform a market benchmark by New charge cap for ‘default’

(SRI) criteria of the underlying funds Provide positive returns in investing in a selection of investments that the investment investment options

European (ex-UK) Equity Shares of companies in Europe (ex-UK) all market conditions, over 0.085 0.100 manager believes will perform better than the market. • Since 6 April 2015, a cap of 0.75% of a member’s fund

the medium to long term The investment manager decides which assets to buy or

Japanese Equity Shares of companies in Japan 0.085 0.096 sell. As returns depend partly on the active involvement (75p per £100) a year has applied to the Total Expense

North American Equity Shares of companies in North America 0.085 0.093 and skill of the manager, typically these funds have higher Ratio (TER) of ‘default’ investment options within defined

investment charges. However, active funds can also be contribution (DC) pension schemes. The TER of a fund is

UK Equity Shares of companies in the UK 0.085 0.089 the Annual Management Charge (AMC) plus any additional

more volatile than passive funds.

World (ex-UK) Equity Shares of companies around the world (ex-UK) 0.085 0.095 expenses incurred.

Passive funds try to replicate a particular benchmark or

Bonds and gilts (%) (%) index, aiming to achieve the same return. Passive funds • This legislation was introduced to protect employees

usually have lower investment charges than active funds. who join DC schemes, and who do not make a specific

Gilts UK government bonds with a maturity 0.085 0.089 choice of which funds they wish to invest in, from paying

period of 15 years or longer Please note: The value of all investment funds can go down charges above this level.

Index-Linked Gilts Index-linked UK government bonds with 0.085 0.089 as well as up. • Unless they choose otherwise, new joiners are invested

a maturity period of five years or longer in the ‘default’ investment option which is Lifestyle –

UK Corporate Bond – Active Investment grade corporate bonds Provide positive returns in 0.305 0.315 Fund factsheets for the Freestyle funds are available Thames for the Plan. The Trustee can confirm that the

denominated in Sterling of all durations – all market conditions, over on the Plan administration website (see page 6). TER throughout the various phases of Lifestyle –

actively managed the medium to long term Thames is lower than 0.75% a year.

UK Corporate Bond – Investment grade corporate bonds 0.085 0.100 • The Trustee can also confirm that, while the cap does

Passive (previously known denominated in Sterling of all durations – What are single-priced funds? not apply to all funds and options, the TER throughout

as UK Corporate Bond) passively managed the various phases of the other two Lifestyle options

All funds available to you in the Plan are priced on what is (Lifestyle – Severn and Lifestyle – Tay) is also lower

Pre-Retirement UK government and corporate bonds 0.178 0.178 known as a ‘single-priced’ basis. This means that the price than 0.75% a year.

you pay for units in a fund is the same as the price you • The TER for the different Freestyle funds depends on the

* Annual Management Charge (AMC) is the annual fee charged by the investment manager. The AMCs shown above are correct as at would receive if you sold units in the same fund on that day. underlying funds in which they invest and the investment

31 December 2016 and are subject to change. AMCs for the active equity and diversified funds will fluctuate slightly with changes approach the investment managers take. As a result,

in the mix of the underlying funds. Single-priced funds absorb the transaction costs that fund

managers incur when they buy or sell units on your behalf. some of the higher-charged, actively-managed funds

** Total Expense Ratio (TER) is the total cost of investing in the fund. It is automatically deducted from the price of the funds in which have a TER of more than 0.75% a year. As members are

you are invested. The TER includes the AMC and any other additional fund expenses such as trading fees, legal fees, auditor fees and This can affect the unit price depending on the amount

other operational expenses. The TERs shown above are correct as at 31 December 2016 and are subject to change. of units bought and sold each day. required to actively choose these funds, the Freestyle

funds are not subject to the charge cap.

The price at which units in a fund are bought and sold may

change considerably from one day to the next, depending on Please note that the Trustee regularly reviews the charges

the activity of other investors, and the scale of this change that apply to all of your investment options to ensure that

will be dependent on the liquidity of the funds. they remain competitive and deliver value for money for

members in relation to the charges levied.

24 25