Page 6 - 2019 Social Security Cheat Sheet

P. 6

2019 REVISED EDITION:

Social Security Cheat Sheet

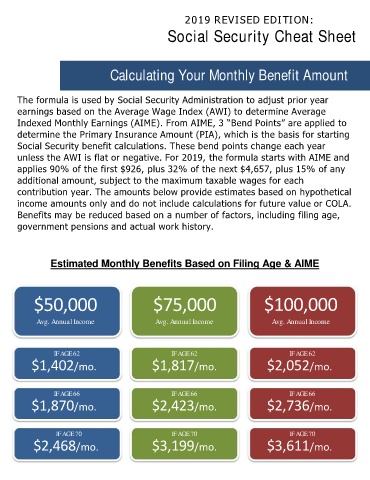

Calculating Your Monthly Benefit Amount

The formula is used by Social Security Administration to adjust prior year

earnings based on the Average Wage Index (AWI) to determine Average

Indexed Monthly Earnings (AIME). From AIME, 3 “Bend Points” are applied to

determine the Primary Insurance Amount (PIA), which is the basis for starting

Social Security benefit calculations. These bend points change each year

unless the AWI is flat or negative. For 2019, the formula starts with AIME and

applies 90% of the first $926, plus 32% of the next $4,657, plus 15% of any

additional amount, subject to the maximum taxable wages for each

contribution year. The amounts below provide estimates based on hypothetical

income amounts only and do not include calculations for future value or COLA.

Benefits may be reduced based on a number of factors, including filing age,

government pensions and actual work history.

Estimated Monthly Benefits Based on Filing Age & AIME

$50,000 $75,000 $100,000

Avg. Annual Income Avg. Annual Income Avg. Annual Income

IF AGE 62 IF AGE 62 IF AGE 62

$1,402/mo. $1,817/mo. $2,052/mo.

IF AGE 66 IF AGE 66 IF AGE 66

$1,870/mo. $2,423/mo. $2,736/mo.

IF AGE 70 IF AGE 70 IF AGE 70

$2,468/mo. $3,199/mo. $3,611/mo.