Page 10 - 2019 Social Security Cheat Sheet

P. 10

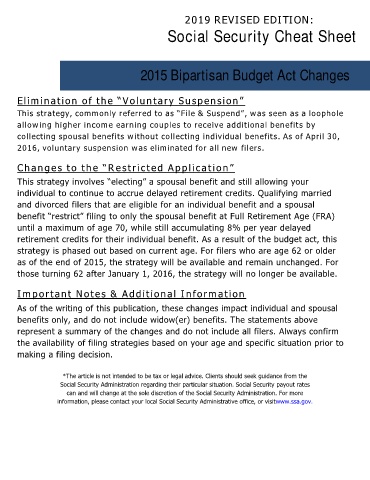

2019 REVISED EDITION:

Social Security Cheat Sheet

2015 Bipartisan Budget Act Changes

Elimination of the “Voluntary Suspension”

This strategy, commonly referred to as “File & Suspend”, was seen as a loophole

allowing higher income earning couples to receive additional benefits by

collecting spousal benefits without collecting individual benefits. As of April 30,

2016, voluntary suspension was eliminated for all new filers.

Changes to the “Restricted Application”

This strategy involves “electing” a spousal benefit and still allowing your

individual to continue to accrue delayed retirement credits. Qualifying married

and divorced filers that are eligible for an individual benefit and a spousal

benefit “restrict” filing to only the spousal benefit at Full Retirement Age (FRA)

until a maximum of age 70, while still accumulating 8% per year delayed

retirement credits for their individual benefit. As a result of the budget act, this

strategy is phased out based on current age. For filers who are age 62 or older

as of the end of 2015, the strategy will be available and remain unchanged. For

those turning 62 after January 1, 2016, the strategy will no longer be available.

Important Notes & Additional Information

As of the writing of this publication, these changes impact individual and spousal

benefits only, and do not include widow(er) benefits. The statements above

represent a summary of the changes and do not include all filers. Always confirm

the availability of filing strategies based on your age and specific situation prior to

making a filing decision.

*The article is not intended to be tax or legal advice. Clients should seek guidance from the

Social Security Administration regarding their particular situation. Social Security payout rates

can and will change at the sole discretion of the Social Security Administration. For more

information, please contact your local Social Security Administrative office, or visitwww.ssa.gov.