Page 11 - 2021 Mid Year Open Enrollment Guide

P. 11

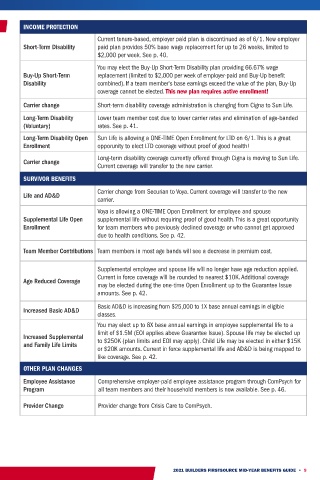

Summary of Changes - Legacy BMC INCOME PROTECTION

Team Members Short-Term Disability Current tenure-based, employer paid plan is discontinued as of 6/1. New employer

paid plan provides 50% base wage replacement for up to 26 weeks, limited to

$2,000 per week. See p. 40.

ELIGIBILITY FOR NEW HIRES

You may elect the Buy-Up Short-Term Disability plan providing 66.67% wage

Team members hired on or after 6/1/21 have a 60-day waiting period. Coverage Buy-Up Short-Term replacement (limited to $2,000 per week of employer-paid and Buy-Up benefit

Waiting Period is effective on the first of the month following or coincident with 60 days of Disability combined). If a team member's base earnings exceed the value of the plan, Buy-Up

employment.

coverage cannot be elected. This new plan requires active enrollment!

MEDICAL

Carrier change Short-term disability coverage administration is changing from Cigna to Sun Life.

Team Member Contributions New earnings-based medical contributions for those enrolled in a BCBS plan. Long-Term Disability Lower team member cost due to lower carrier rates and elimination of age-banded

(Voluntary) rates. See p. 41.

Current United Healthcare members will experience a carrier change to BlueCross Long-Term Disability Open Sun Life is allowing a ONE-TIME Open Enrollment for LTD on 6/1. This is a great

and BlueShield of Texas. See 'How do I find a provider?' under Frequently Asked Enrollment opporunity to elect LTD coverage without proof of good health!

Carrier change Questions on p. 50. Prescription coverage will remain through CVS/Caremark,

however new ID cards will be issued. You will now carry TWO ID cards for medical Carrier change Long-term disability coverage currently offered through Cigna is moving to Sun Life.

and prescription coverage. Current coverage will transfer to the new carrier.

SURVIVOR BENEFITS

Increase in Deductible and Out-of-Pocket limits: EE Only Deductible increased from

$1,700 to $2,600; EE + Dep(s) Deductible increased from $3,400 to $5,200. Carrier change from Securian to Voya. Current coverage will transfer to the new

Core HDHP Individual Out-of-Pocket limit increased from $5,100 to $7,000. Bundled Basic Critical Life and AD&D carrier.

Illness coverage (company-paid) now applies only to the employee. Voluntary Employee

and Dependent Critical Illness coverage may be purchased by the team member. Voya is allowing a ONE-TIME Open Enrollment for employee and spouse

Supplemental Life Open supplemental life without requiring proof of good health. This is a great opportunity

The Standard PPO Plan includes set copays for doctor office visits, making access to Enrollment for team members who previously declined coverage or who cannot get approved

New Medical Plan Offering due to health conditions. See p. 42.

health care affordable to more team members. See p. 14 for plan details.

Team members enrolled in a BCBS medical plan also have access to programs like Team Member Contributions Team members in most age bands will see a decrease in premium cost.

New Value-Added Programs Blue Care Connection, Naturally Slim, Virta diabetes management, Hinge Health joint

health, tobacco cessation program and more. See pp. 20-28.

Supplemental employee and spouse life will no longer have age reduction applied.

Health Savings Account All employer contributions to Health Savings Accounts are discontinued as of 6/1. Current in force coverage will be rounded to nearest $10K. Additional coverage

Age Reduced Coverage

BMC team members will now have the ability to contribute to a General Purpose may be elected during the one-time Open Enrollment up to the Guarantee Issue

Flexible Spending Account amounts. See p. 42.

Health Flexible Spending Account. See p. 36.

Basic AD&D is increasing from $25,000 to 1X base annual earnings in eligible

DENTAL Increased Basic AD&D

classes.

Carrier Change Dental coverage offered through Cigna is changing to MetLife. See p. 34. You may elect up to 8X base annual earnings in employee supplemental life to a

limit of $1.5M (EOI applies above Guarantee Issue). Spouse life may be elected up

The employer subsidy to the dental plan is being discontinued. Team members will Increased Supplemental

Team Member Contributions to $250K (plan limits and EOI may apply). Child Life may be elected in either $15K

pay 100% of the cost of dental coverage. and Family Life Limits

or $20K amounts. Current in force supplemental life and AD&D is being mapped to

VISION like coverage. See p. 42.

Carrier Change Carrier change from Cigna to EyeMed. OTHER PLAN CHANGES

Team Member Contributions Lower payroll contributions for the same coverage. Employee Assistance Comprehensive employer-paid employee assistance program through ComPsych for

Program all team members and their household members is now available. See p. 46.

SUPPLEMENTAL HEALTH PLANS

Provider Change Provider change from Crisis Care to ComPsych.

Supplemental plans currently offered through Cigna will be mapped to new plan

Carrier change coverage with Voya. This includes supplemental coverage for Critical Illness, Hospital

Indemnity and Accident.

In most cases, enrollees will see lower contribution costs for the same or similar

Team Member Contributions

coverage.

8 • 2021 BUILDERS FIRSTSOURCE MID-YEAR BENEFITS GUIDE 2021 BUILDERS FIRSTSOURCE MID-YEAR BENEFITS GUIDE • 9