Page 41 - PowerPoint Template

P. 41

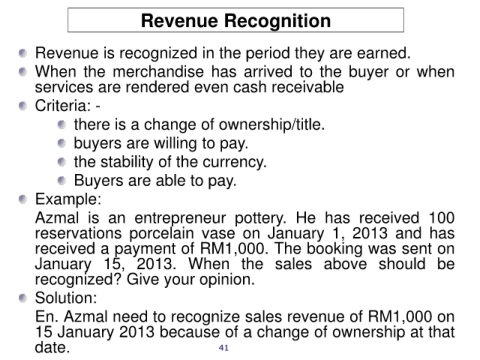

Revenue Recognition

Revenue is recognized in the period they are earned.

When the merchandise has arrived to the buyer or when

services are rendered even cash receivable

Criteria: -

there is a change of ownership/title.

buyers are willing to pay.

the stability of the currency.

Buyers are able to pay.

Example:

Azmal is an entrepreneur pottery. He has received 100

reservations porcelain vase on January 1, 2013 and has

received a payment of RM1,000. The booking was sent on

January 15, 2013. When the sales above should be

recognized? Give your opinion.

Solution:

En. Azmal need to recognize sales revenue of RM1,000 on

15 January 2013 because of a change of ownership at that

date. 41