Page 42 - PowerPoint Template

P. 42

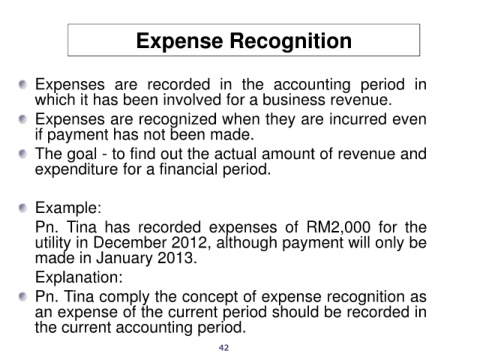

Expense Recognition

Expenses are recorded in the accounting period in

which it has been involved for a business revenue.

Expenses are recognized when they are incurred even

if payment has not been made.

The goal - to find out the actual amount of revenue and

expenditure for a financial period.

Example:

Pn. Tina has recorded expenses of RM2,000 for the

utility in December 2012, although payment will only be

made in January 2013.

Explanation:

Pn. Tina comply the concept of expense recognition as

an expense of the current period should be recorded in

the current accounting period.

42