Page 63 - Hybrid PBD Matematik TG3_Edisi Guru

P. 63

Matematik Tingkatan 3 Bab 3

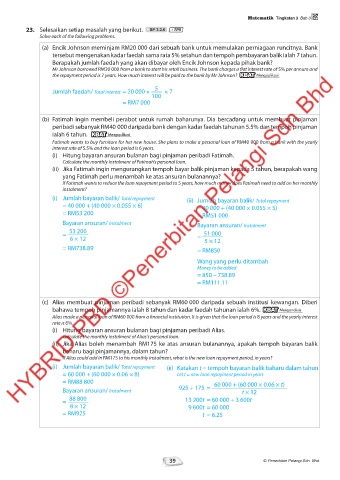

23. Selesaikan setiap masalah yang berikut. SP 3.2.6 TP5

Solve each of the following problems.

(a) Encik Johnson meminjam RM20 000 dari sebuah bank untuk memulakan perniagaan runcitnya. Bank

tersebut mengenakan kadar faedah sama rata 5% setahun dan tempoh pembayaran balik ialah 7 tahun.

Berapakah jumlah faedah yang akan dibayar oleh Encik Johnson kepada pihak bank?

Mr Johnson borrowed RM20 000 from a bank to start his retail business. The bank charges a flat interest rate of 5% per annum and

the repayment period is 7 years. How much interest will be paid to the bank by Mr Johnson? KBAT Mengaplikasi

Jumlah faedah/ Total interest = 20 000 × 5 × 7

100

= RM7 000

(b) Fatimah ingin membeli perabot untuk rumah baharunya. Dia bercadang untuk membuat pinjaman

peribadi sebanyak RM40 000 daripada bank dengan kadar faedah tahunan 5.5% dan tempoh pinjaman

ialah 6 tahun. KBAT Mengaplikasi

Fatimah wants to buy furniture for her new house. She plans to make a personal loan of RM40 000 from a bank with the yearly

interest rate of 5.5% and the loan period is 6 years.

(i) Hitung bayaran ansuran bulanan bagi pinjaman peribadi Fatimah.

Calculate the monthly instalment of Fatimah’s personal loan.

(ii) Jika Fatimah ingin mengurangkan tempoh bayar balik pinjaman kepada 5 tahun, berapakah wang

yang Fatimah perlu menambah ke atas ansuran bulanannya?

If Fatimah wants to reduce the loan repayment period to 5 years, how much money does Fatimah need to add on her monthly

instalment?

(i) Jumlah bayaran balik/ Total repayment (ii) Jumlah bayaran balik/ Total repayment

= 40 000 + (40 000 × 0.055 × 6) = 40 000 + (40 000 × 0.055 × 5)

= RM53 200 = RM51 000

Bayaran ansuran/ Instalment Bayaran ansuran/ Instalment

= 53 200 51 000

6 × 12 = 5 × 12

= RM738.89 = RM850

Wang yang perlu ditambah

Money to be added

= 850 – 738.89

= RM111.11

(c) Alias membuat pinjaman peribadi sebanyak RM60 000 daripada sebuah institusi kewangan. Diberi

bahawa tempoh pinjamannya ialah 8 tahun dan kadar faedah tahunan ialah 6%. KBAT Menganalisis

Alias made a personal loan of RM60 000 from a financial institution. It is given that the loan period is 8 years and the yearly interest

rate is 6%.

(i) Hitung bayaran ansuran bulanan bagi pinjaman peribadi Alias.

Calculate the monthly instalment of Alias's personal loan.

(ii) Jika Alias boleh menambah RM175 ke atas ansuran bulanannya, apakah tempoh bayaran balik

baharu bagi pinjamannya, dalam tahun?

If Alias could add in RM175 to his monthly instalment, what is the new loan repayment period, in years?

(i) Jumlah bayaran balik/ Total repayment (ii) Katakan t = tempoh bayaran balik baharu dalam tahun

= 60 000 + (60 000 × 0.06 × 8) Let t = new loan repayment period in years

= RM88 800 60 000 + (60 000 × 0.06 × t)

Bayaran ansuran/ Instalment 925 + 175 = t × 12

= 88 800 13 200t = 60 000 + 3 600t

8 × 12 9 600t = 60 000

= RM925 t = 6.25

39 © Penerbitan Pelangi Sdn. Bhd.

03_ Hybrid Mate Tg3.indd 39 20/08/2021 5:30 PM