Page 70 - Hybrid PBD Matematik TG3_Edisi Guru

P. 70

Matematik Tingkatan 3 Bab 3

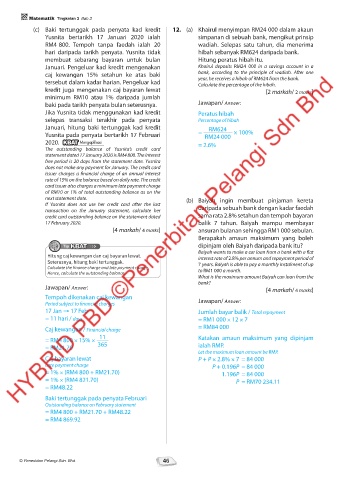

(c) Baki tertunggak pada penyata kad kredit 12. (a) Khairul menyimpan RM24 000 dalam akaun

Yusnita bertarikh 17 Januari 2020 ialah simpanan di sebuah bank, mengikut prinsip

RM4 800. Tempoh tanpa faedah ialah 20 wadiah. Selepas satu tahun, dia menerima

hari daripada tarikh penyata. Yusnita tidak hibah sebanyak RM624 daripada bank.

membuat sebarang bayaran untuk bulan Hitung peratus hibah itu.

Januari. Pengeluar kad kredit mengenakan Khairul deposits RM24 000 in a savings account in a

caj kewangan 15% setahun ke atas baki bank, according to the principle of wadiah. After one

year, he receives a hibah of RM624 from the bank.

tersebut dalam kadar harian. Pengeluar kad Calculate the percentage of the hibah.

kredit juga mengenakan caj bayaran lewat [2 markah/ 2 marks]

minimum RM10 atau 1% daripada jumlah

baki pada tarikh penyata bulan seterusnya. Jawapan/ Answer:

Jika Yusnita tidak menggunakan kad kredit Peratus hibah

selepas transaksi terakhir pada penyata Percentage of hibah

Januari, hitung baki tertunggak kad kredit RM624

Yusnita pada penyata bertarikh 17 Februari = RM24 000 × 100%

2020. KBAT Mengaplikasi = 2.6%

The outstanding balance of Yusnita’s credit card

statement dated 17 January 2020 is RM4 800. The interest

free period is 20 days from the statement date. Yusnita

does not make any payment for January. The credit card

issuer charges a financial charge of an annual interest

rate of 15% on the balance based on daily rate. The credit

card issuer also charges a minimum late payment charge

of RM10 or 1% of total outstanding balance as on the

next statement date. (b) Baiyah ingin membuat pinjaman kereta

If Yusnita does not use her credit card after the last

transaction on the January statement, calculate her daripada sebuah bank dengan kadar faedah

credit card outstanding balance on the statement dated sama rata 2.8% setahun dan tempoh bayaran

17 February 2020. balik 7 tahun. Baiyah mampu membayar

[4 markah/ 4 marks] ansuran bulanan sehingga RM1 000 sebulan.

Berapakah amaun maksimum yang boleh

Tip KBATKBAT dipinjam oleh Baiyah daripada bank itu?

KBAT

Baiyah wants to make a car loan from a bank with a flat

Hitung caj kewangan dan caj bayaran lewat. interest rate of 2.8% per annum and repayment period of

Seterusnya, hitung baki tertunggak. 7 years. Baiyah is able to pay a monthly instalment of up

Calculate the finance charge and late payment charge. to RM1 000 a month.

Hence, calculate the outstanding balance. What is the maximum amount Baiyah can loan from the

bank?

Jawapan/ Answer: [4 markah/ 4 marks]

Tempoh dikenakan caj kewangan

Period subject to financial charges Jawapan/ Answer:

17 Jan → 17 Feb Jumlah bayar balik / Total repayment

= 11 hari / days = RM1 000 × 12 × 7

Caj kewangan / Financial charge = RM84 000

= RM4 800 × 15% × 11 Katakan amaun maksimum yang dipinjam

= RM21.70 365 ialah RMP.

Let the maximum loan amount be RMP.

Caj bayaran lewat P + P × 2.8% × 7 = 84 000

Late payment charge P + 0.196P = 84 000

= 1% × (RM4 800 + RM21.70) 1.196P = 84 000

= 1% × (RM4 821.70) P = RM70 234.11

= RM48.22

Baki tertunggak pada penyata Februari

Outstanding balance on February statement

= RM4 800 + RM21.70 + RM48.22

= RM4 869.92

© Penerbitan Pelangi Sdn. Bhd. 46

03_ Hybrid Mate Tg3.indd 46 20/08/2021 5:30 PM