Page 87 - Newmark Northwest 2021 Samples

P. 87

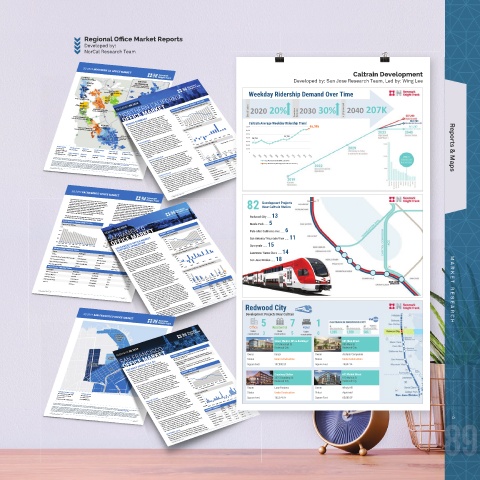

Regional O ce Market Reports

Developed by:

NorCal Research Team

Caltrain Development

3Q 2019 NORTHERN CA OFFICE MARKET

↑ SONOMA

Novato-Santa Rosa-Petaluma Developed by: San Jose Research Team, Led by: Wing Lee

GREATER

NORTH SACRAMENTO

BAY Placer County-Sacramento County

Yolo County-El Dorado County

NORTH I-680 Weekday Ridership Demand Over Time

NORTHERN CALIFORNIA

Concord-Pleasant Hill-Walnut Creek

MARIN

Novato-San Rafael-Sausalito

EAST

SAN BAY

FRANCISCO RESEARCH 3Q 2019 NORTHERN CALIFORNIA MARKET ANALYSIS 14.0% 13.0%

TRI-VALLEY

GREATER OAKLAND San Ramon-Dublin-Pleasanton Full Service Asking Rent ($/SF) and Availability Rate (%) 12.0% 2020 20% 2030 30% High Speed Rail 2040 207K

Berkeley-Emeryville-Oakland OFFICE MARKET 11.0% 10.0% Electrification Downtown Extension

The Northern California office market posted 968,301 square feet of

NORTH PENINSULA $4.25 $3.95 3Q19 9.0% 207,200

consecutive quarter of positive absorption. Strong leasing activity,

Brisbane-San Mateo-San Carlos REGION SUMMARY $3.65 $3.35 3Q17 1Q18 3Q18 1Q19 Availability (%) 184,700

especially on quality, transit-oriented spaces, continues to push down

1Q17

total average asking rent increased $0.07 to $4.20/SF. In the largest

3Q16

direct lease deal of the quarter, 8x8 Inc. leased 177,815 square feet at

SILICON positive net absorption in the third quarter. This marks the eighth $3.05 $2.75 1Q16 Average Asking Rent (Price/SF) Caltrain Average Weekday Ridership Trend 65,095 161,200

South Bay Development’s Creekside Way project in Campbell. 8x8 will

SOUTH PENINSULA VALLEY the overall availability rate, which finished the quarter at 10.0%. The Net Absorption (SF, Millions) 70,000

whereupon occupation, 8x8 will be the largest employer in the city.

60,000

Redwood City-Palo Alto- Mountain View

Demand of 7.6 million square feet outpaced supply of 6.5 million

square feet, and the overall vacancy rate dropped to 2.8%. The city

SOUTH BAY relocate its San Jose HQ to the new Campbell space in early 2020, 5.0 3.5 2.0 1Q19 3Q19 50,000 34,120

SOUTH BAY

granted Prop M allocations to several developments during the

Sunnyvale-Santa Clara-West Valley

summer, but these projects are not expected to break ground until

Sunnyvale-Santa Clara-West Valley

Proposed

Milpitas-San Jose

Milpitas-San Jose SAN FRANCISCO 0.5 -1.0 1Q17 3Q17 1Q18 3Q18 Currently U/C Proposed 40,000 26,794

2020. Vacancy is expected to stay low, and supply and demand will

30,000

3Q16

1Q16

64.0

BONNIE READD KELLY DONG remain unbalanced until at least 2022. The restricted supply continues -2.5 Construction Pipeline (SF, Millions) 20,000

0.6 0.0

ANDREA ARATA Reports & Maps

VP, Research WENDI LIU 0.6 0.0 10,000

San Francisco to push asking rates, which increased 8.9% year-over-year to

Greater

Sacramento

Northern California MICKEY MORAN 0.0 0.3 0.3

South Peninsula $82.23/SF. Class A asking rates increased 10.5% year-over-year to 65.0 Greater

408.987.4197 South Bay KYLE PHILLIPS MAX GUNARI 52.0 1.7 4.4 Sacramento 0

the close of the prior quarter. On the sublease front, availability

CHRIS TERANISHI Greater Oakland 9.9 North North

breadd@ngkf.com WING LEE N I-680 & Tri-Valley KELLY DONG 8.3 Bay Bay

N I-680 & Tri-Valley

North Peninsula Sacramento 39.0 East Bay

Sacramento

availability. Tenant demand decreased 16.6% in the third quarter of

South Bay MILES WHITTEMORE Overall availability decreased this quarter to 9.4%, down from 9.7% at 26.0 3.3 8.7 1.4 Silicon Year Ago

2019 to 3.0 million square feet, with the bulk of the requirements now

North

South Bay JACOB MOLLOY $91.22/SF. IA MARKET SUMMARY

ERIC PARSONS Valley Period

378M SF

in the 10,000 to 20,000-square-foot-range. 405 East Fourth Avenue in

Quarter

Greater Oakland NORTH PENINSULA 13.0 Peninsula Prior Prior 378M SF

Quarter

Current

San

North Bay there may be adjustments in accounted for 2.4% of the total inventory and 33.3% of the total 0.0 NORTHERN CALIFORNIA MARKET SUMMARY 693K SF 11.3% 11.3% 1.8M SF $4.60/SF Avg. Weekday Ridership(AWR: until 2017)

Francisco

San Mateo completed construction this quarter, delivering 62,338-

380M SF

380M SF

Quarter

1.8M SF

10.8%

382M SF

10.8%

382M SF

Avg. Mid-Weekday Ridership(AWR: until 2017 and later )

$3.97/SF

$3.97/SF

693K SF

10.0%

10.0%

Newmark Knight Frank has implemented a proprietary database and our tracking methodology has been revised. With this expansion and refinement in our data, there may be adjustments in

historical statistics including availability, asking rents, absorption and effective rents. Newmark Knight Frank Research Reports are available at www.ngkf.com/research

$4.60/SF

$4.13/SF

968K SF

968K SF

$4.13/SF

The lengthy growth cycle has many concerned the market is nearing a

South Peninsula Availability & Asking Rents Tick Up

1.3M SF

$4.77/SF

All information contained in this publication is derived from sources that are deemed to be reliable. However, Newmark Knight Frank (NKF) has not verified any such information, and the same

downturn, yet gross absorption for the first three quarters of 2019 was

$4.20/SF

ch information, and the same

© NEWMARK KNIGHT FRANK | 2019

Availability Rate

Quarterly Net Absorption

formation and all other information

constitutes the statements and representations only of the source thereof, and not of NKF. Any recipient of this publication should independently verify such information and all other information

1.9M SF

transmit, copy, broadcast, upload, download, or in any other way reproduce this publication or any of the information it contains.

1.9M SF

$4.78/SF

that may be material to any decision that recipient may make in response to this publication, and should consult with professionals of the recipient’s choice with regard to all aspects of that

nearly 200,000 square feet greater than that for the same time last

Total Average FS Asking Rent

decision, including its legal, financial, and tax aspects and implications. Any recipient of this publication may not, without the prior written approval of NGKF, distribute, disseminate, publish,

SILICON VALLEY

year. One notable transaction was Softbank’s lease at Middle Plaza,

1.6M SF

1.6M SF

not only because of its size but also because it was pre-leased well in

advance of delivery, a sign of confidence that the region will remain

RESEARCH | 7 square-feet of pre-leased inventory to the downtown market. Total Inventory Total Class A Avg FS Asking Rent $4.20/SF $4.78/SF $4.77/SF 1.3M SF RESEARCH | 1

strong. Demand-driven opportunism will carry the market through the

Deliveries

end of the year, when patient tenants will be able to jump on quality

and viable options.

© NEWMARK KNIGHT FRANK | 2019

3Q 2019 SACRAMENTO OFFICE MARKET

82 Development Projects

Value-add plays 2868 Prospect Park Drive and 2882 Prospect Park

Drive sold for $152/SF and $179/SF, respectively, and attracted the

Near Caltrain Station

interest of investors from across the country. The growing number of

activity has been in a well-diversified number of fields, while both

companies with different investment criteria that are entering the

stabilized and investment capital continues to regard the region as a

market underscores how attractive Sacramento remains to

viable option for investment. Inventory remains low, which will give

institutional investors. With 400 Capitol Mall likely to trade in the

Redwood City …… 13

landlords confidence as they pull back on rental concessions, such

fourth quarter and 3000 and 3010 Lava Ridge Court and 980 9th

as free rent and TI allowances, which are now approaching levels not

Street hitting the market, Downtown and Roseville are proving to be

markets that are attractive to investment capital.

seen since before 2008. Both leasing and sales activity remain robust

and have continued to encourage landlords to raise asking rents,

which are still below historical peaks in most submarkets. Although

Overall, the third quarter continued the positive trends and reinforced

Menlo Park …… 5

the market is not likely to top its total absorption total for 2018, it has

the fundamentals of the Sacramento metropolitan market. Tenant

quarter on a strong note.

enough momentum to put up good numbers and finish out the fourth

AVAILABILITY BREAKDOWN BY TYPE

6.0 SACRAMENTO MARKET ANALYSIS 17.2%

Square Feet, Millions

16.0 AVAILABILITY BREAKDOWN BY CLASS

Square Feet, Millions

12.0 RESEARCH 3Q 2019 22.0% 19.6% Palo Alto/ California Ave …… 6

15.0

8.0 12.0 Asking Rent & Availability 14.8%

4.0 9.0 OFFICE MARKET $2.00 12.4% 10.0% San Antonio/ Mountain View …… 11

0.0 6.0 $1.90 3Q19

third quarter of 2019, which is typically the slowest quarter of the year.

3Q14 1Q15 3Q15 3.0 SACRAMENTO OFFICE MARKET 3Q18 Vacancy (%)

The office market posted 197,968 square feet of positive net absorption

1Q16

3Q16

1Q17 3Q17 $1.80 3Q17 Sunnyvale ……15

and brought the year-to-date total to a positive 621,605 square feet.

Sublease Availability 1Q18 3Q18 1Q19 3Q19 0.0 3Q17NUES MOMENTUM $1.70 3Q16

Direct Availability

3Q15 3Q15 1Q16 1Q16 3Q16 1Q17 The Sacramento office market maintained its positive momentum in the $1.60 Average Asking Rent ($/SF)

3Q15

3Q16

1Q17

Class C CONTI 3Q17 1Q18 1Q18 3Q18 3Q18 1Q19 1Q19 $1.50 3Q14

SELECT LEASE TRANSACTIONS

Class C

Tenant

Tenant Class B Class A 3Q19 3Q19 Net Absorption (Square Feet, Thousands) Lawrence/ Santa Clara …… 14

Building(s)

WeWork

WeWork Building(s) This marks the 12th consecutive quarter of positive net absorption for

Submarket the market. Its vacancy rate also dropped to 10.8% from 11.2%.

Submarket

660 J St

660 J St

Type

Downtown

State of CA Dept of Forestry & Fire Protection

on Downtown Type Downtown Sacramento led the quarter with 97,213 square feet of 900 3Q19 San Jose Diridon …… 18

Square Feet

Square Feet

710 Riverpoint

Direct Lease

NEC Corporation of America 710 Riverpoint Ct Ct Direct Lease positive net absorption. This was largely due to the 96,300-square-foot 600 3Q18

West Sacramento

96,300

West Sacramento WeWork lease signed at 660 J Street and the 23,380-square-foot lease 300

10850 Gold Center Dr 96,300 3Q17

Direct Lease

State of CA Dept of Social Services

State of CA Dept of Social Services er Dr Direct Lease with Delta Conveyance Design at 980 9th Street. 50 Corridor East also 0

50 Corridor East

The leading submarkets at the end of the third quarter of 2019 are

50 Corridor East

76,438

76,438

1640 E Roseville Pkwy

Delta Conveyance Design 1640 E Roseville Pkwy had a solid third quarter with 65,136 square feet of positive net 3Q16

Lease Renewal absorption, followed by Rocklin with 56,371 square feet of positive net

Lease Renewal

Roseville

Roseville -300 3Q15

980 9 th St St 35,071 Construction & Deliveries (Square Feet, Thousands)

35,071

Direct Lease

Direct Lease -600

SELECT SALE TRANSACTIONS 3Q14

Downtown

Downtown

26,000

Building(s) 26,000

Building(s)

Direct Lease Douglas Corridor of Roseville, Downtown and 50 Corridor East. To date,

Direct Lease

23,380

23,380

Submarket

2868 Prospect Park Dr Submarket absorption. the Douglas Corridor of Roseville has posted 300,131 square feet of

Sale Price positive net absorption, while Downtown has posted 225,305 square 2019

Sale Price

50 Corridor East 800

$/RSF

3001 Lava Ridge Ct or East $/RSF feet, which combined makes up approximately 85% of the overall 2018

3001 Lava Ridge Ct

$25,000,000 640 2017 Projected

$25,000,000

Roseville

Square Feet

Roseville Square Feet market’s positive net absorption year to date. Downtown Sacramento

2300 River Plaza Dr

2300 River Plaza Dr $152 and 50 Corridor continue to see a lot of tenant activity from the State of 480 2016

$152

12 Month

$24,900,000 2015

$24,900,000

Forecast

South Natomas 164,821 California and Sacramento County, as both entities continue to expand 320 12 Month

South Natomas

164,821

$230

2882 Prospect Park Dr $230 2014 Under Construction Forecast

$22,000,000 in the market. Roseville, though not a market that attracts much 2013

$22,000,000

1130 K St

108,348

1130 K St 50 Corridor East $275 108,348 government use, continues to do well with non-government related 160 0 2012 Year Ago

Period

$275

or East

$20,700,000 uses, healthcare and private entrepreneurs growing footprints or 2011 Prior

$20,700,000

80,000

Downtown 80,000 looking for space. Given the amount of tenant activity in the submarket, Deliveries Quarter 69.2M SF

dropped from 11.2% in second-quarter 2019 to 10.8%. The region has

Downtown

$179

not seen a rate this low since 2003. West Sacramento led the area with

$19,500,000 $179 MARKET SUMMARY Current 69.5M SF 12.6%

$19,500,000

115,593

$138 115,593 expect it to continue to do well in the fourth quarter of 2019. Quarter

$138

a 4.6% vacancy, followed by Folsom with a 5.8% vacancy (after posting

140,908

$1.97/SF

$1.97/SF

140,908 As noted above, the Sacramento metropolitan region’s vacancy rate Total Inventory 69.7M SF 10.8% 198K SF 11.2% 380K SF $2.00/SF 104K SF 345K SF MARKET RESEARCH

6.6% vacancy. Tenant activity continues to be strong. Other notable

leaders are South Natomas at 6.6%, Elk Grove/Laguna at 6.6% and the

$2.00/SF

345K SF

Douglas Corridor of Roseville at 7.6%. As vacancy continues to drop, the

© NEWMARK KNIGHT FRANK | 2018

$1.97/SF

643K SF

Quarterly Net Absorption

lack of inventory will be felt in most of the top-performing markets and

280K SF

643K SF

will remain an issue for the foreseeable future. Healthcare, insurance,

Total FS Asking Rent

housing, state and local government, engineering and technology

60K SF

Under Construction

RESEARCH | 2 44,386 of positive net absorption in the third quarter) and Rocklin with a Total Availability Rate $1.97/SF 643K SF 60K SF 643K SF 280K SF 0 0 RESEARCH | 1 Redwood City

Investment activity remained strong in the third quarter. Investors in

Deliveries

wood City

both the stabilized asset and value-add asset classes were very active.

Red

The stabilized properties 3001 Lava Ridge Court and 2300 River Plaza

Drive sold for $230/SF and $275/SF, indicating there is a lot of interest

continue to be market drivers.

in fully stabilized buildings in the Sacramento metro market.

r Ca

Development Projects Near Caltrain

r Ca

jects

ro

ent P

in

ltra

Nea

in

Develo

Develo

pm

pm

5 5

© NEWMARK KNIGHT FRANK | 2018

3Q 2019 SAN FRANCISCO OFFICE MARKET

Of fi ce ent P ro jects Nea ntial ltra 7 7 Hotel el 1 1

Hot

Residential

de

Resi

Office

d

nd

Un

U Under e r Under er Under

Un

er

d

s

ion

ion

r

u

ct

co

u

t

r

n

n

u

r

s

n

ion

co

construction 3 3 construction 5 5 co construction 0 0

t

ct

t

s

ct

5

Main Street

Kaiser Medical Office Building 2

88

Kais er M edi cal Off i ce B u i l di n g 2 885 Main Street

S

885 Main St

s

r

75

11 1175 Marshall St t 88 5 Ma in d Cit t y

Ma

S

all

h

SAN FRANCISCO CURRENT CONDITIONS 10.0% 8.0% 6.0% 4.0% Owner er Feet Kai der er 0 Const r u ct io n Ow q atu n ar er s e Feet A Acclaim Companies

Redwoo

Redwood City

Redwoo

d Cit

y

Redwood City

RESEARCH 3Q 2019

Overall vacancy dropped to 2.8%; Class A vacancy dropped 40

OFFICE MARKET

Demand of 7.6 million square feet outpaced availability of 6.5

million square feet; leasing volume continued to be constrained by

Owner

s

Ow

s

Compan

Kaiser

n

ie

cclaim

basis points to just 2.1%.

Class A rates increased 10.5% year over year to $91.22/SF.

ta

on

C

Status

der

tus

Un

Annual direct asking rates increased 8.9% in the same period to

St

Under Construction

t

r

s

o

n

u

cti

Under Construction

Status

S

Un

VACANCY DROPS TO 2.8%

At the end of the third quarter of 2019, the overall vacancy rate

dropped 40 basis points to 2.8%, and overall availability dropped 70

limited supply.

Square Feet

u

78

78,832 SF

S

S

2

197,800 SF

0 SF

F

Sq

Square Feet

u

,83

are

197,8

basis points to 7.8%, while demand of 7.6 million square feet outpaced

supply. Year-to-date leasing activity remained constrained, down 26.3%

compared with the same period last year. Despite the tight market,

MARKET ANALYSIS

$86.23/SF.

over half of which resulted from Dropbox’s move into 656,482 square

Asking Rent and Vacancy

y Stati

B

roadwa

al

W

n

t Street

u

0

61

Of the 3.3 million square feet currently under construction 84.0% has

been pre-leased or is rumored to be in leases. Although the city granted

S

u

t

Br

t

75

oadway

61

2075 Broadway St

20

0

Waln

610 Walnut St

Prop M allocations to several developments during the summer, these

feet at 1800 Owens Street.

3Q19

Redwoo

y

Redwood City

Redwood City

d Cit

d Cit

y

Redwoo

projects are not expected to break ground this year. As a result,

vacancy is expected to stay low, and supply and demand will remain

unbalanced until at least 2022 or 2023. The restricted supply continues

Average Asking Rent ($/SF)

to push asking rates, which increased 8.9% year-over-year to

3Q14

$82.23/SF. Class A asking rates increased 10.5% year-over-year to

n

Windy Hill

ers

Win

L

Lane Partners

Ow

n

3Q13

ane

t

dy H

Owner

il

l

Par

3Q12

d

S

ta

Approved

Status

A

ove

S

Status

pp

r

tus

Un

Const

der

Under Construction

ct

u

r

Despite the tight market, several landlords have noticed a slowdown in

NEWMARK KNIGHT FRANK

ANDREA ARATA more than 1.0 million square feet was absorbed during the quarter, $100 $80 $60 $40 $20 $0 Net Absorption (SF) 3Q15 3Q16 3Q17 3Q18 Vacancy (%) 2.0% 0.0% Ow ta n tus er Broadway Station on S io t n Owner er 610 Walnut Street

possible reason for this delay is that smaller tenants might hesitate at

One Bush Street, Suite 1500

e Feet

ar

u

65,080 SF

u

10

2,0

ar

e Feet

9 S

San Francisco, CA 94104 Research Director 1,600,000

7

S

q

q

S

the longer term lengths required and therefore seek alternatives

415.445.5155 3Q19 3Q19 Square Feet 102,079 SF F Square Feet 65 ,08 0 S F

SMALLER LEASES 800,000 400,000 -400,000 0 3Q11 3Q11 3Q12 3Q12 3Q13 3Q13 3Q14 3Q14 3Q15 3Q15 3Q16 3Q16 Prior Year Ago Period Period 82.8M SF 12 Month

elsewhere, whether in coworking spaces or nearby markets. Another

415.445.5133 $91.22/SF. 1,200,000 3Q18 3Q18

factor possibly affecting this size range is a change in venture funding

aarata@ngkf.com the time it takes to lease spaces of less than 20,000 square feet. One 3Q17 3Q17

Corporate CA RE #: 00832933

Forecast

Year Ago

investments in smaller companies. If tenants are concerned about rent

while the amount of funding has increased, resulting in fewer

82.8M SF

Quarter

liabilities on their balance sheets, shorter-term or less expensive

83.5M SF

Quarter

942K SF

83.3M SF

Recent headlines featuring large San Francisco tenants have many

historical statistics including availability, asking rents, absorption and effective rents. Newmark Knight Frank Research Reports are available at www.ngkf.com/research

Newmark Knight Frank has implemented a proprietary database and our tracking methodology has been revised. With this expansion and refinement in our data, there may be adjustments in

there may be adjustments in

328K SF

$79.16/SF

$79.16/SF

people speculating what the long-term result will be if a company puts

leases are a more favorable option.

Total Inventory

1.1M SF

4.3M SF

$84.89/SF

$84.89/SF

market has a lot of wiggle-room: if the amount of space that came back

ch information, and the same over the past few years: the total number of investments has dropped, MARKET SUMMARY Current 83.3M SF 2.9% 2.9% 1.1M SF $86.23/SF Quarter 83.5M SF 3.2% 3.2% 328K SF 3.3M SF 3.9% 3.9% 942K SF 4.3M SF 300K SF RESEARCH | 1

All information contained in this publication is derived from sources that are deemed to be reliable. However, Newmark Knight Frank (NKF) has not verified any such information, and the same

© NEWMARK KNIGHT FRANK | 2019

constitutes the statements and representations only of the source thereof, and not of NKF. Any recipient of this publication should independently verify such information and all other information

Vacancy Rate

formation and all other information

300K SF

Quarterly Net Absorption

transmit, copy, broadcast, upload, download, or in any other way reproduce this publication or any of the information it contains.

3.3M SF

$86.23/SF

that may be material to any decision that recipient may make in response to this publication, and should consult with professionals of the recipient’s choice with regard to all aspects of that

RESEARCH | 1

on the market during the eight quarters of recession were to come

back on the market right now, it would result in a 6.7% vacancy. Overall,

736K SF

decision, including its legal, financial, and tax aspects and implications. Any recipient of this publication may not, without the prior written approval of NGKF, distribute, disseminate, publish,

3.3M SF

this market is fairly insulated against a wobble in the economy.

Under Construction

RESEARCH | 4 significant space back on the market. However, with 2.8% vacancy, this Average FS Asking Rent 3.3M SF 0 SF 0 SF 736K SF

Jamestown purchased Levi’s Plaza for $826.0 million from Gerson

Deliveries

Bakar in one of the largest office deals in San Francisco history. The

building portfolio includes an office footprint of five buildings totaling

931,160 square feet. The largest tenant, Levi Strauss & Co, has a lease

INVESTMENT SALES 89

© NEWMARK KNIGHT FRANK | 2019