Page 1053 - How to Make Money in Stocks Trilogy

P. 1053

40 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

shaken to the point of near collapse. The Nasdaq had lost over half its value

since the start of the bear market in November 2007, and countless investors

had suffered similar losses. (Of course, anyone who followed the Selling

Checklist in this book would have avoided any serious damage. Hint, hint . . .)

So by March 2009, a lot of folks had taken a beating and were in no mood

to jump back into the stock market anytime soon. The doom and gloom

headlines only seemed to confirm those fears.

But for investors who understood how market cycles work, the signs of a

potential new uptrend were there—as were the tremendous money-making

opportunities that emerge at the beginning of every new bull market.

That brings up another important fact: New market uptrends tend to

begin when the economic and other news is bad.

That’s why the follow-through day is such a valuable tool: Instead of

wringing your hands at the latest headlines and trying to guess when the

market might turn around, just wait for a follow-through day, knowing that

new uptrends never begin without one.

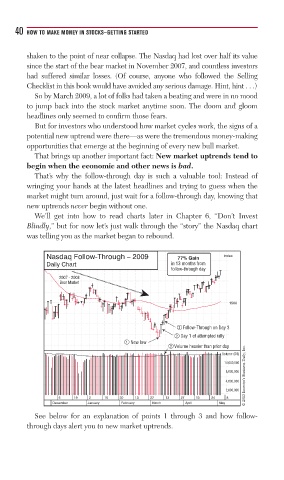

We’ll get into how to read charts later in Chapter 6, “Don’t Invest

Blindly,” but for now let’s just walk through the “story” the Nasdaq chart

was telling you as the market began to rebound.

Nasdaq Follow-Through – 2009 77% Gain Index

Daily Chart in 13 months from

follow-through day

2007 - 2008

Bear Market

1500

3 Follow-Through on Day 3

2 Day 1 of attempted rally

1 New low

3 Volume heavier than prior day

© 2013 Investor’s Business Daily, Inc.

Volume (00)

14,000,000

8,000,000

4,000,000

2,000,000

5 19 2 16 30 13 27 13 27 10 24 8

December January February March April May

See below for an explanation of points 1 through 3 and how follow-

through days alert you to new market uptrends.