Page 1077 - How to Make Money in Stocks Trilogy

P. 1077

Buying Checklist 63

■ ✔ Ranked in top 40–50 of IBD’s 197 industry groups

As IBD founder Bill O’Neil has said, “You cannot overstate the impor-

tance of being aware of new group movements.”

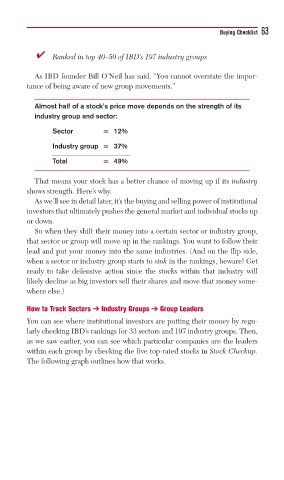

Almost half of a stock’s price move depends on the strength of its

industry group and sector:

Sector = 12%

Industry group = 37%

Total = 49%

That means your stock has a better chance of moving up if its industry

shows strength. Here’s why.

As we’ll see in detail later, it’s the buying and selling power of institutional

investors that ultimately pushes the general market and individual stocks up

or down.

So when they shift their money into a certain sector or industry group,

that sector or group will move up in the rankings. You want to follow their

lead and put your money into the same industries. (And on the flip side,

when a sector or industry group starts to sink in the rankings, beware! Get

ready to take defensive action since the stocks within that industry will

likely decline as big investors sell their shares and move that money some-

where else.)

How to Track Sectors ➔ Industry Groups ➔ Group Leaders

You can see where institutional investors are putting their money by regu-

larly checking IBD’s rankings for 33 sectors and 197 industry groups. Then,

as we saw earlier, you can see which particular companies are the leaders

within each group by checking the five top-rated stocks in Stock Checkup.

The following graph outlines how that works.