Page 1147 - How to Make Money in Stocks Trilogy

P. 1147

132 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

Defensive Selling to Cut Short

Any Losses and Protect Your Gains

I think this is true for just about any investor: We start out with 2 basic emo-

tions—hope and fear. We hope we’ll make a ton of money ASAP. But we also

fear we’ll lose our shirts.

Wouldn’t it be nice to have a little peace of mind—some simple guide-

lines that will make sure you don’t get burned?

That’s where the “Defensive Selling” segment of the checklist comes in.

To avoid any serious damage, just follow these basic sell rules. If

you do that, even when a severe bear market hits like it did in 2008, you can

rest easy, knowing you’ve proactively protected yourself by sticking to a

sound game plan.

Let’s start with a look at the first two “Defensive Selling” criteria. Then

we’ll get into the chart-related items in Chapter 6, “Don’t Invest Blindly:

Use Charts to See the Best Time to Buy and Sell.”

Selling Checklist

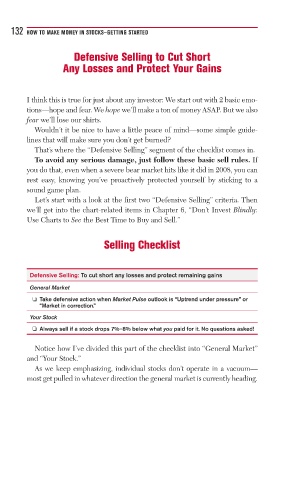

Defensive Selling: To cut short any losses and protect remaining gains

General Market

❏ Take defensive action when Market Pulse outlook is “Uptrend under pressure” or

“Market in correction.”

Your Stock

❏ Always sell if a stock drops 7%–8% below what you paid for it. No questions asked!

Notice how I’ve divided this part of the checklist into “General Market”

and “Your Stock.”

As we keep emphasizing, individual stocks don’t operate in a vacuum—

most get pulled in whatever direction the general market is currently heading.